Have you ever found yourself in need of quick cash? —whether it’s for an unexpected bill, a dream vacation, or just to consolidate some pesky debt—you’ve probably stumbled across the term “unsecured loans online.” But what exactly are they, and why are they so popular in today’s digital age? Don’t worry, I’ve got you covered! In this guide, we’re going to break down everything you need to know about unsecured loans online, from what they are to how to get one, and even the potential pitfalls to watch out for. By the end, you’ll be equipped to make smart, informed decisions about whether this type of loan is right for you. Let’s dive in!

What Are Unsecured Loans Online?

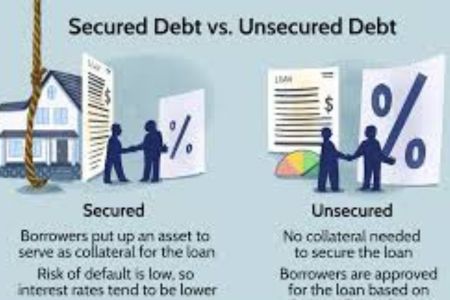

First things first: unsecured loans are loans that don’t require you to put up any collateral. That means no risking your house, car, or other valuable assets to secure the loan. Sounds great, right? Well, it is—but there’s a catch. Since lenders don’t have that safety net, they often charge higher interest rates to offset the risk. So, while you’re not putting your property on the line, you might end up paying more in the long run.

Now, add “online” to the mix, and you’ve got a whole new level of convenience. Online platforms have revolutionized the lending world, making it easier than ever to apply for loans from the comfort of your couch. With just a few clicks, you can compare lenders, submit applications, and even get approved in a matter of minutes. But, as with anything that seems too good to be true, it’s important to tread carefully.

Why Choose Unsecured Loans Online? The Benefits and Risks

Let’s talk about why unsecured loans online are so appealing—and why you should still keep your guard up.

Benefits

- No Collateral Needed: You don’t have to risk your home or car. That’s a huge relief for many borrowers.

- Quick and Convenient: Online applications are fast, and you can often get approved within hours or days, not weeks.

- Versatile Use: Whether it’s for debt consolidation, home improvements, or a surprise medical bill, unsecured loans can cover a wide range of needs.

- Accessible: Even if you don’t have perfect credit, there are options out there for you (though terms may vary).

Risks

- Higher Interest Rates: Without collateral, lenders charge more to protect themselves.

- Debt Trap Potential: The ease of applying can lead to impulsive borrowing, and before you know it, you’re in over your head.

- Predatory Lenders: Not all online lenders are created equal. Some might have hidden fees or unfair terms, so it’s crucial to do your homework.

Types of Unsecured Loans You Can Get Online

Unsecured loans come in several flavors, each with its own perks and quirks. Here’s a quick rundown:

Personal Loans

- What They Are: Fixed-amount loans you can use for almost anything—think debt consolidation, home repairs, or even a wedding.

- Key Features: Typically come with fixed interest rates and repayment terms, making them predictable.

Credit Cards

- What They Are: Revolving credit lines that let you borrow up to a certain limit.

- Why They’re Popular: Super convenient for everyday purchases, but watch out—interest can pile up fast if you don’t pay off the balance each month.

Student Loans

- What They Are: Loans specifically for education expenses.

- Online Options: Private lenders often offer competitive rates or flexible repayment plans that federal loans might not.

Peer-to-Peer Lending

- What It Is: A platform that connects borrowers directly with individual investors.

- Why It’s Cool: You might score better terms than with traditional lenders, and investors can earn higher returns than they would with savings accounts.

How to Apply for Unsecured Loans Online: A Step-by-Step Guide

Ready to take the plunge? Here’s how the application process typically works:

- Research Lenders: Start by comparing online lenders. Look at interest rates, fees, and customer reviews.

- Check Your Credit: Your credit score will play a big role in what terms you’re offered. If it’s low, consider ways to boost it first.

- Gather Your Info: You’ll need personal details, proof of income, and possibly bank statements.

- Fill Out the Application: Most online lenders have simple forms. Be honest—lenders will verify your info.

- Wait for Approval: This can take anywhere from a few minutes to a few days, depending on the lender.

- Review the Terms: If approved, read the fine print carefully. Make sure you understand the interest rate, repayment schedule, and any fees.

Pro Tip: Always apply with multiple lenders to compare offers. It’s like dating—you want to find the best match!

The Role of Credit Scores: What You Need to Know

Your credit score is like your financial report card, and lenders take it seriously. Here’s the deal:

- High Credit Score (700+): You’re in the driver’s seat. Expect lower interest rates and better terms.

- Average Credit Score (600-699): You’ll likely still qualify, but rates might be higher.

- Low Credit Score (Below 600): Options are limited, and you might face sky-high rates. Consider improving your score first or exploring bad credit loan options.

If your credit isn’t great, don’t panic. Some lenders specialize in loans for people with less-than-perfect credit. Just be prepared for higher costs and make sure you can handle the repayments.

Comparison Shopping: Don’t Settle for the First Offer

With so many online lenders out there, it pays to shop around. Here’s how to do it right:

- Use Comparison Tools: Websites like LendingTree or NerdWallet let you compare rates from multiple lenders at once.

- Look Beyond Interest Rates: Fees, repayment flexibility, and customer service matter too.

- Read Reviews: See what other borrowers have to say. If a lender has a lot of complaints, steer clear.

Remember, the goal is to find the best deal for your situation. Don’t rush—take your time and weigh your options.

Responsible Borrowing: How to Stay Out of Trouble

Unsecured loans can be a lifesaver, but they can also lead to a debt spiral if you’re not careful. Here’s how to borrow smart:

- Only Borrow What You Need: It’s tempting to take out a little extra, but resist the urge. More debt means more interest.

- Understand the Total Cost: Look at the APR (annual percentage rate), not just the monthly payment. That’s the real cost of the loan.

- Have a Repayment Plan: Before you borrow, make sure you can afford the payments. Budgeting tools can help.

- Avoid Impulse Borrowing: Just because it’s easy to apply doesn’t mean you should. Think it through.

Regulatory Considerations: Know Your Rights

Online lending is regulated, but the rules vary by country and state. In the U.S., for example, the Consumer Financial Protection Bureau (CFPB) keeps an eye on lenders to ensure they’re playing fair. Here’s what you should know:

- Truth in Lending Act: Lenders must disclose all terms and costs upfront.

- Fair Credit Reporting Act: You have the right to know what’s in your credit report and dispute errors.

- State Laws: Some states cap interest rates or have additional protections for borrowers.

If something feels off, don’t hesitate to reach out to regulatory bodies or seek legal advice.

The Future of Unsecured Loans Online: What’s Next?

The online lending space is evolving fast, and it’s exciting to think about what’s coming. Here are a few trends to watch:

- AI-Driven Approvals: Artificial intelligence is making loan decisions faster and more accurate.

- Blockchain Technology: This could streamline the lending process and make it more secure.

- Personalized Offers: Lenders are getting better at tailoring loans to individual needs, which could mean better terms for borrowers.

While these innovations are promising, it’s still early days. As always, stay informed and cautious.

Real-Life Examples: Learning from Others

Let’s look at a couple of stories to see how unsecured loans online can play out.

Success Story

Meet Sarah, a 28-year-old graphic designer. She had $10,000 in credit card debt with sky-high interest rates. By taking out an unsecured personal loan online at a lower rate, she consolidated her debt and paid it off in three years, saving thousands in interest. Smart move, Sarah!

Cautionary Tale

Then there’s Mike, who took out multiple unsecured loans to fund a lavish lifestyle. He didn’t have a repayment plan and quickly found himself drowning in debt. Eventually, he had to file for bankruptcy. The lesson? Borrow responsibly and always have a plan.

FREQUENTLY ASKED QUESTIONS

Upgrade : Best for Bad Credit.

Happy Money : Best For Credit Card Debt Consolidation.

LightStream : Best for Low Interest Rates.

LendingClub : Best for Debt Consolidation.

SoFi® : Best For Good To Excellent Credit.

PenFed : Best for Credit Union Financing.

Upstart : Best for No Credit.

U.S. Bank : Best for Traditional Banking.

Renmoney: Renmoney has been around for a while and has a good reputation among lenders. …

Page Financials: Page Financials is another online lender with a history. …

Zitra Investments: Although Zitra Investments is the “new kid on the block”, the management team has acknowledgable experience in Finance.

Conclusion: Your Next Steps

So, there you have it—your complete guide to unsecured loans online. Whether you’re looking to fund a big purchase, consolidate debt, or cover an emergency expense, these loans can be a great tool if you use them wisely. Here’s what to do next:

- Assess Your Needs: Figure out exactly how much you need and why.

- Check Your Credit: Know where you stand and if you need to improve your score.

- Shop Around: Compare lenders to find the best deal.

- Read the Fine Print: Understand the terms before you sign anything.

- Borrow Responsibly: Only take what you can afford to repay.

And remember, if you’re ever in doubt, don’t hesitate to seek advice from a financial professional. You’ve got this—now go make informed decisions and take control of your financial future!