If you’re reading this, chances are you’re either about to dive into the wild world of higher education or you’re already knee-deep in it, trying to figure out how to pay for it all without breaking the bank. Student loans are a lifeline for millions of students, but let’s be real—they can also feel like a heavy backpack you’ve been lugging around for years. The good news? Not all student loans are created equal, and snagging one with a low interest rate can save you a tonne of cash down the road. In this guide, I’m going to walk you through everything you need to know about student loans with low interest rates. We’ll cover what they are, why they matter, how to find them, and how to manage them like a pro—all in a way that’s easy to digest and maybe even a little fun. Ready? Let’s get started!

What Are Student Loans?

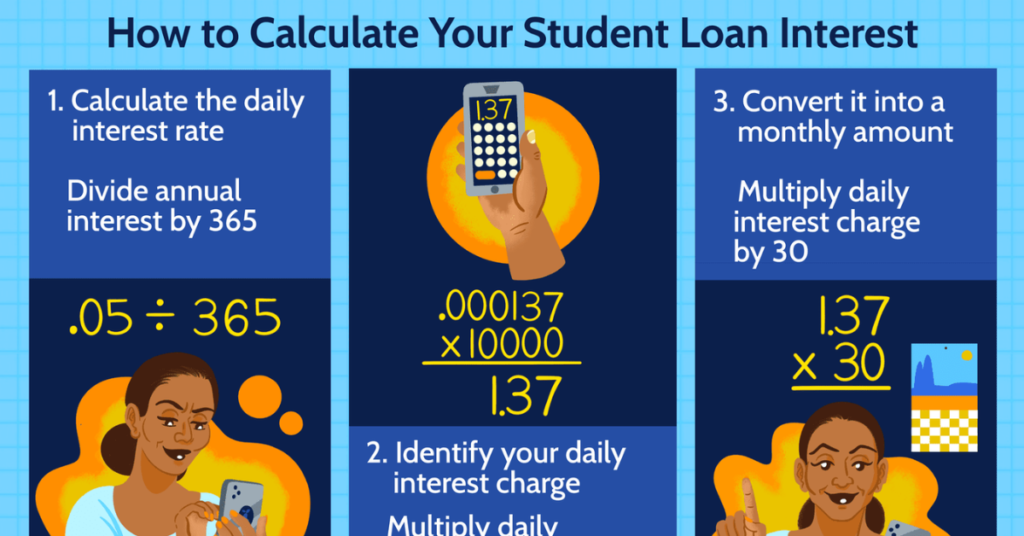

Okay, let’s kick things off with the basics. Student loans are money you borrow to cover the costs of your education—think tuition, textbooks, dorm rent, or even that overpriced coffee you’ll need to survive late-night study sessions. Unlike grants or scholarships (aka free money—woo!), you’ve got to pay student loans back, usually with some extra cash tacked on called interest. That interest is basically the price tag for borrowing, and it’s where the whole “low interest rate” thing becomes a game-changer. There are two big players in the student loan game:

- Federal Student Loans: These come straight from the U.S. government (if you’re in the States, that is). They’re known for having lower interest rates and perks like flexible repayment plans. Sweet deal, right?

- Private Student Loans: These are offered by banks, credit unions, or other lenders. Interest rates can be all over the place—sometimes low, sometimes sky-high—depending on your credit score and whether you’ve got a co-signer with a fancy financial history.

Most folks (myself included, back in the day) lean toward federal loans because they’re usually cheaper and come with more safety nets. But don’t worry—we’ll dig into both options so you can see what fits your vibe.

Why Student Loans with Low Interest Rates Are a Big Deal

Alright, let’s talk about why interest rates are the VIPs of the student loan world. Picture this: Interest is like a sneaky little fee that gets added to what you owe. The higher the rate, the more you’re shelling out over time. A low interest rate? That’s your ticket to keeping more of your hard-earned money later.

Here’s a quick example to blow your mind. Say you borrow $20,000 for college. With a 6% interest rate over 10 years, you’re paying back about $26,645 total. Ouch. Now, drop that rate to 3%, and your total drops to $23,228. That’s over $3,400 saved—enough for a sweet vacation or, you know, a couple of months’ rent. Even a tiny dip in the rate can mean big bucks in your pocket, so hunting down low-interest student loans is worth the effort.

Types of Student Loans with Low Interest Rates

Not sure where to start? Let’s break down the main types of student loans that tend to come with those wallet-friendly low rates. I’ve got details on each, so you can figure out which one’s calling your name.

1. Federal Direct Subsidized Loans

These are the golden unicorns of student loans, especially if you’re tight on cash. They’re need-based, meaning you’ve got to show you can’t cover college costs on your own. The coolest part? The government covers the interest while you’re in school, during a six-month grace period after graduation, and if you hit pause on payments later (called deferment). No interest piling up? Yes, please!

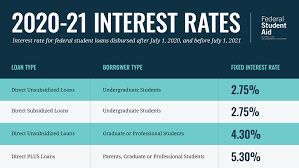

- Interest Rate: For 2023-2024, it’s 5.50%. Not the lowest ever, but still pretty solid.

- Who’s Eligible: Undergrads with financial need. Fill out the FAFSA (more on that later) to see if you qualify.

2. Federal Direct Unsubsidized Loans

These are like the subsidized loans’ chill cousins. They’re not need-based, so anyone can grab them—undergrads and grad students alike. The catch? Interest starts ticking the second the money hits your account. You can let it pile up and deal with it later, but it’ll grow if you don’t tackle it early.

- Interest Rate: 5.50% for undergrads, 7.05% for grad students (2023-2024).

- Who’s Eligible: Pretty much any student enrolled at least half-time. No financial need required.

3. Federal PLUS Loans

Got grad school dreams or parents willing to chip in? PLUS loans are for graduate students or parents of undergrads. The rates are higher than other federal options, but they’re still usually lower than what private lenders throw at you.

- Interest Rate: 8.05% (2023-2024). Not super low, but manageable compared to some private loans.

- Who’s Eligible: You’ll need decent credit (or a co-signer with it) and no major financial red flags.

4. Private Loans with Low Rates

Okay, private loans are the wild cards. Some lenders—like SoFi or Earnest—offer crazy-low rates if your credit’s sparkling or you’ve got a co-signer who’s basically a financial superhero. But here’s the deal: Private loans don’t have the same forgiveness or flexibility as federal ones, so they’re best as a backup plan.

- Interest Rate: Could be as low as 3-4% with stellar credit, but it varies wildly.

- Who’s Eligible: Depends on the lender—good credit or a co-signer usually seals the deal.

How to Score a Student Loans with Low Interest Rates

Finding a low-interest loan isn’t like stumbling across a four-leaf clover—it takes some strategy. Here’s your step-by-step playbook to snag the best deal possible.

Step 1: Hit Up the FAFSA First

If you’re in the U.S., the Free Application for Federal Student Aid (FAFSA) is your golden ticket. It’s how you unlock federal loans, grants, and work-study cash. File it every year (yep, even if you’re already in school), and do it early—like, October 1st early—to max out your options. Trust me, those federal rates are hard to beat.

Step 2: Shop Around for Private Loans (If You Need To)

Maxed out your federal loans and still short? Time to check out private lenders. Look for:

- Fixed Rates: These stay the same, so no nasty surprises.

- No Fees: Some lenders skip origination fees, saving you cash upfront.

- Auto-Pay Discounts: A little 0.25% rate cut for setting up automatic payments? Yes, please.

Pro tip: Compare at least three lenders. Sites like Credible can show you rates without dinging your credit.

Step 3: Boost Your Credit Game

Private lenders love a good credit score. If yours is shaky (or nonexistent—hi, new students!), ask a parent or someone you trust to co-sign. Just know they’re on the hook if you miss payments, so don’t leave them hanging.

Step 4: Check Out State Programs

Some states have their own low-interest loan deals for residents. For example, Massachusetts has the No Interest Loan program with—you guessed it—0% interest for eligible undergrads. Google your state’s higher education agency to see what’s up.

Step 5: Think About Refinancing Later

Already got loans with meh rates? Refinancing means swapping them for a new loan with a lower rate. It’s a post-grad move, but beware—if you refinance federal loans into private ones, you lose federal perks like forgiveness. Weigh it carefully.

Managing Your Student Loans Like a Boss

Got your low-interest loan? Awesome! Now let’s talk about keeping that debt under control. These tips will help you stay ahead of the game.

1. Pay Interest Early (If You Can)

For unsubsidized loans, interest starts growing right away. Even tossing $20 a month at it while you’re in school stops it from ballooning. I wish I’d done this—my loan balance would’ve been way less intimidating after graduation.

2. Pick a Smart Repayment Plan

Federal loans give you options. Standard plans are 10 years, but if cash is tight, income-driven plans cap payments at a chunk of your income (like 10%). Struggling? Look into these—they’re lifesavers.

3. Automate Your Payments

Set up auto-pay. It’s one less thing to stress about, and lots of lenders knock off 0.25% from your rate as a bonus. Win-win!

4. Throw Extra Cash at It

Got a little extra from a summer job or a birthday gift? Put it toward your loan. Paying more than the minimum cuts down interest and gets you debt-free faster.

5. Skip the Pause Button

Deferment or forbearance sounds tempting when money’s tight, but interest keeps stacking up on most loans. If you can swing it, keep paying to avoid a bigger mess later.

A Real-Life Look at Student Loans with Low Interest Rates

Let’s paint a picture. Imagine you’ve got $40,000 in loans. At 6% interest over 10 years, your monthly payment is $444, and you’ll pay $53,280 total. Now, snag a 4% rate instead—your payment drops to $405, and the total’s $48,600. That’s $4,680 saved! That’s not pocket change—that’s a used car or a killer grad school fund.

Mistakes You Don’t Want to Make

I’ve seen friends (and okay, myself) trip over these student loan traps. Here’s what to dodge:

- Overborrowing: Only take what you need. Extra cash now means extra debt later.

- Ignoring Rates: A low monthly payment might hide a high rate. Check the big picture.

- Skipping Payments: Late payments tank your credit and add fees. Set reminders or go auto-pay.

- Missing Free Money: Don’t skip the FAFSA or scholarships—free cash beats loans any day.

The minimum maintenance loan is: £3,907 if you live at home (for incomes of £58,349 or above). £6,853 if you study away from home in London (for incomes of £70,116+). £4,915 if you study away from home elsewhere (for incomes of £62,377+) .

For most student borrowers, federal Direct loans are the better option. They almost always cost less and are easier to repay.

Federal Subsidized and Unsubsidized student loans are a great starting point for most students because they don’t require a credit check and offer the same fixed, low rates for all borrowers.

Conclusion: You’ve Got This!

Student loans might feel like a mountain to climb, but with low interest rates in your corner, it’s more like a manageable hill. Start with federal loans, explore private options if you must, and keep your debt in check with smart moves like early payments and the right repayment plan. You’re not just borrowing money—you’re investing in your future, and doing it wisely can save you thousands.

So, take a deep breath, file that FAFSA, and start researching your options. You’ve got the tools now to make student loans work for you, not against you. Got questions? Hit up a financial aid office or drop a comment—I’m rooting for you!