Are you a business owner and wonder how to get same day business loans? Let’s talk about something that might just save your day—or at least your cash flow. Running a business is no walk in the park, right? One minute you’re cruising along, and the next, bam—an unexpected expense hits you out of nowhere. Maybe it’s a broken piece of equipment, a sudden inventory shortage, or a golden opportunity you can’t pass up.

Whatever it is, you need cash, and you need it now. That’s where same day business loans swoop in like a superhero in a cape. In this article, I’m going to break down everything you need to know about these speedy funding options—how they work, who they’re for, the pros and cons, and tips to snag one without breaking a sweat. Buckle up, because we’re diving deep into the world of fast-track financing!

What Are Same Day Business Loans, Anyway?

Picture this: a loan that lands in your bank account the same day you apply for it. Sounds like a dream, doesn’t it? Well, same day business loans make that dream a reality. These are short-term financing options designed to get you cash quickly—usually within 24 hours or even faster. Unlike traditional bank loans that take weeks (or months) to process, same day loans cut through the red tape and deliver funds when you’re in a pinch.

They’re typically offered by online lenders, fintech companies, or alternative funding platforms rather than your old-school brick-and-mortar banks. The goal? Speed and simplicity. Whether you’re a small business owner, a freelancer, or running a growing startup, these loans can be a lifeline when time isn’t on your side. But here’s the kicker—they’re not one-size-fits-all, so let’s unpack what makes them tick.

How Do Same Day Business Loans Work?

Alright, let’s get into the nitty-gritty. How do these loans actually go from “I need money” to “Money’s in my account” in a single day? It’s all about streamlining the process. Traditional loans involve endless paperwork, credit checks that feel like a background investigation, and waiting periods that test your patience. Same day loans? They flip the script.

First off, most applications are online. You hop onto a lender’s website, fill out a quick form—think basic details like your business name, revenue, and how much you need—and hit submit. Lenders use tech like algorithms and automated systems to review your application in minutes. Instead of digging through years of financial history, they often focus on your recent cash flow or revenue. Some even connect directly to your business bank account to get a real-time snapshot of your finances.

Once approved, the funds are wired to your account via ACH transfer or direct deposit, often within hours. Boom—done! The catch? Speed comes at a cost, usually in the form of higher interest rates or fees. But when you’re racing against the clock, that trade-off might just be worth it.

Who Can Get a Same Day Business Loan?

Here’s the good news: same day business loans are pretty inclusive. You don’t need a pristine credit score or a decade-long business history to qualify. These loans are built for real-world entrepreneurs—the hustlers, the dreamers, and even the ones who’ve hit a few bumps along the way.

Typically, lenders look at:

- Your revenue: Most want to see consistent cash flow, like $10,000 a month or more, to know you can repay the loan.

- Time in business: Some require at least six months, but others are cool with newer ventures.

- Credit score:** While bad credit won’t always disqualify you, a decent score (say, 500 or higher) boosts your odds.

Freelancers, e-commerce sellers, restaurant owners, and even startups can get in on the action. Got a seasonal business that needs a quick boost? Perfect. Facing an emergency repair? You’re covered. The flexibility here is a game-changer, especially if traditional banks have slammed the door in your face.

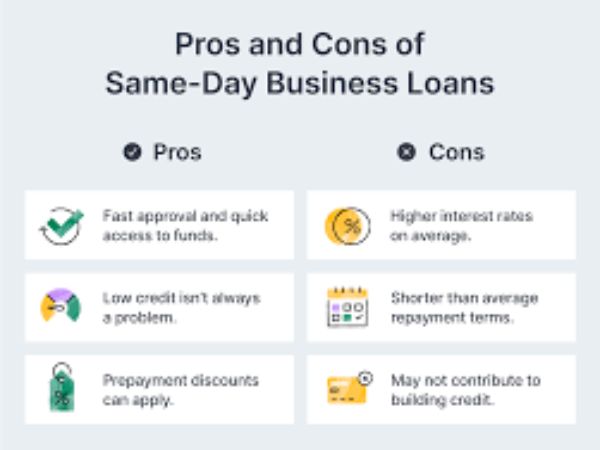

The Pros of Same Day Business Loans

Let’s talk about why these loans are a big deal. Speed’s the obvious star of the show, but there’s more to love.

- Lightning-Fast Funding

Need cash by 5 p.m.? With same day loans, that’s not a pipe dream—it’s the whole point. Whether it’s paying an overdue supplier or seizing a last-minute deal, you’re not left twiddling your thumbs. - Easy Application Process

No need to dig up tax returns from five years ago or write a 20-page business plan. The online process is straightforward, and you can often apply from your phone while sipping coffee. - Flexible Eligibility

Bad credit? New business? No problem. These loans cater to folks who don’t fit the mold of traditional lending, giving you a shot when others won’t. - No Collateral Needed (Sometimes)

Many same day loans are unsecured, meaning you don’t have to risk your house or car to get funded. It’s all about your business’s potential, not your personal assets. - Handles Emergencies Like a Champ

When the unexpected hits—like a busted HVAC system or a sudden payroll crunch—these loans keep your business afloat without missing a beat.

Sounds awesome, right? But hold up—there’s another side to this coin.

The Cons You Need to Watch Out For

Nothing’s perfect, and same day business loans have their quirks. Before you dive in, let’s weigh the downsides.

- Higher Costs

Speed comes with a price tag. Interest rates can climb into the double digits, and some lenders tack on hefty origination fees. You might pay more than you would with a slower, cheaper loan. - Short Repayment Terms

These loans aren’t built for the long haul. Terms often range from three months to a year, with daily or weekly payments. If your cash flow’s tight, that can feel like a pressure cooker. - Smaller Loan Amounts

Don’t expect a million bucks. Same day loans typically range from $5,000 to $250,000, depending on your revenue. Great for quick fixes, but not for massive projects. - Risk of Debt Traps

If you’re not careful, those frequent payments can pile up, especially if business slows down. It’s easy to get stuck borrowing again to cover the last loan. - Not All Lenders Are Legit

The online lending world has its share of shady players. Predatory lenders might hit you with hidden fees or sky-high rates, so you’ve got to do your homework.

It’s a balancing act—convenience versus cost. Knowing these pitfalls helps you play it smart.

Types of Same Day Business Loans

Same day funding isn’t a monolith. You’ve got options, and each one’s got its own vibe. Here’s the lineup:

- Payday Loans for Businesses

Think small, super-short-term loans—often repaid in weeks. They’re quick but pricey, so use them as a last resort. - Merchant Cash Advances (MCA)

Not technically a loan, an MCA gives you cash upfront based on future credit card sales. Repayment comes from daily sales, making it flexible but expensive. - Short-Term Business Loans

The classic choice. You get a lump sum, repay it over months, and enjoy predictable payments. Rates vary, but approval’s fast. - Business Lines of Credit

Like a credit card for your business. Draw funds as needed, pay interest only on what you use, and reuse it as you repay. Perfect for ongoing cash flow needs. - Invoice Financing

Got unpaid invoices? Lenders advance you cash based on what’s owed to you. It’s same-day money without adding debt—just a fee for the service.

Each type fits different scenarios, so pick the one that matches your hustle.

How to Get a Same Day Business Loan (Without Losing Your Mind)

Ready to grab one? Here’s your step-by-step playbook:

- Know What You Need

Figure out how much cash you’re after and what it’s for. Lenders love clarity, and it keeps you from overborrowing. - Check Your Stats

Peek at your revenue, credit score, and time in business. This tells you which lenders will give you a nod. - Shop Around

Don’t settle for the first offer. Compare rates, fees, and terms from multiple lenders. Online marketplaces like Fundera or Lendio make this a breeze. - Gather Your Docs

Most ask for basics: bank statements, ID, and maybe a tax return. Have them ready to speed things up. - Apply Like a Pro

Fill out the online form honestly and double-check your details. Typos can slow you down. - Review the Fine Print

Before signing, read the terms. Look for hidden fees, prepayment penalties, or anything fishy. - Get Your Cash

Once approved, the funds hit your account—sometimes in hours. Use them wisely!

Pro tip: Apply early in the day to boost your chances of same-day funding. Time’s your friend here.

Are Same Day Business Loans Right for You?

Here’s the million-dollar question: should you go for it? It depends on your situation. If you’re facing a cash crunch that’s threatening to derail your business—like a supplier cutting you off or a client ghosting on payment—this could be your lifeline. Same day loans shine in emergencies or when speed trumps cost.

But if you’re planning a big expansion or don’t need the money ASAP, pump the brakes. A traditional loan with lower rates might save you cash in the long run. Ask yourself: Can I handle the repayments? Is the cost worth the convenience? If the answer’s yes, you’re golden.

Tips to Maximize Your Same Day Loan Experience

Let’s wrap this up with some insider hacks to make the most of your loan:

- Borrow Only What You Need: It’s tempting to grab extra, but more debt means more stress.

- Have a Repayment Plan: Map out how you’ll pay it back before the cash hits your account.

- Boost Your Credit: Even a slightly better score can snag you lower rates next time.

- Build a Lender Relationship: Stick with a good one—they might cut you better deals down the road.

- Stay Organized: Track payments and deadlines to avoid late fees.

Conclusion: Your Fast Cash Lifeline

So, there you have it—same day business loans in all their glory. They’re fast, they’re flexible, and they’re a godsend when life throws you a curveball. Sure, they come with higher costs and shorter terms, but when your business is on the line, that speed can be a game-changer. Whether you’re fixing a crisis or jumping on an opportunity, these loans give you the power to act now, not later. Just play it smart—shop around, read the fine print, and borrow with a plan. Got a cash emergency? Same day business loans might just be your new best friend. What do you think—ready to give them a whirl?