Hey there! If you’re in Nigeria and have ever found yourself in a financial pinch—maybe an unexpected bill popped up or you just need a little extra cash to tide you over—then you’ve probably heard about quick loan apps. These nifty little tools have taken the country by storm, offering fast, hassle-free access to funds right from your smartphone. No long queues at the bank, no endless paperwork—just a few taps, and boom, money in your account! But with so many options out there, how do you know which one’s the best for you? Don’t worry; I’ve got you covered. In this guide, we’ll dive deep into the world of quick loan app in Nigeria, exploring how they work, the top players, their pros and cons, and some tips to use them wisely. Let’s get started!

What is Quick Loan App, Anyway?

So, what’s the deal with these quick loan apps? Simply put, they’re mobile applications designed to give you instant access to small, short-term loans without the usual rigmarole of traditional banking. Imagine this: your car breaks down, and you need ₦50,000 pronto to fix it. Instead of begging a friend or waiting weeks for a bank loan, you whip out your phone, download an app, apply in minutes, and—voila!—the cash hits your account faster than you can say “emergency”.

These apps use technology to make lending super quick and convenient. They often rely on your phone data—like SMS history or bank details tied to your BVN (Bank Verification Number)—to figure out if you’re good for the money. No collateral, no guarantor, just you, your phone, and a need for cash. Sounds pretty cool, right? Well, it is—but there’s more to it, and we’ll unpack it all as we go.

Why is the Quick Loan App in Nigeria So Popular?

Let’s be real: Nigeria’s economy can be a rollercoaster. Inflation’s up, salaries don’t always stretch far enough, and unexpected expenses? They’re practically a national pastime! That’s where quick loan apps swoop in like superheroes. They’ve become insanely popular because they solve a real problem—getting money fast when you need it most.

For starters, they’re accessible. You don’t need to own a house or a fancy car to qualify. If you’ve got a smartphone and a bank account, you’re halfway there. Plus, the process is digital, meaning no trekking to a bank branch in Lagos traffic. And let’s not forget speed—some apps disburse funds in as little as five minutes! In a country where “urgent 2K” is a common phrase, that kind of speed is a game-changer.

Another reason? Flexibility. Whether you need ₦10,000 for a quick fix or ₦500,000 for something bigger, there’s an app for that. And with Nigeria’s growing fintech scene, these apps are popping up left, right, and centre, giving you plenty of choices. But popularity doesn’t mean perfection—there are pitfalls, and we’ll get to those later.

How Does the Quick Loan App in Nigeria Work?

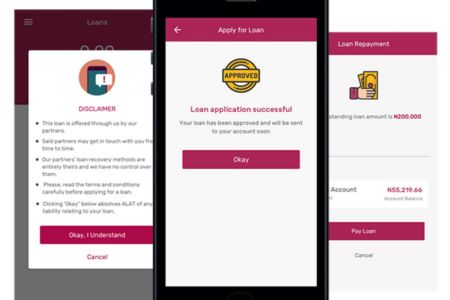

Okay, let’s break it down. How do these apps actually get money into your hands so fast? It’s not magic (though it might feel like it!). Here’s the step-by-step:

- Download and Register: You grab the app from Google Play Store (sorry iPhone folks, some are Android-only), sign up with your phone number, and link your bank account or BVN.

- Apply for a Loan: Fill out a quick form—think name, amount you want, and repayment period. No need for a 10-page essay!

- Approval Check: The app uses fancy algorithms to scan your data (like your transaction history) and decide if you’re creditworthy. This takes minutes, not days.

- Cash Out: Once approved, the money lands in your account faster than Usain Bolt running the 100-meter Dash.

- Repay: You pay back through the app, usually with interest, by a set date. Some even let you repay early for a discount.

The beauty? It’s all online, 24/7. Need a loan at 2 a.m.? No problem. But here’s the catch: those algorithms aren’t foolproof, and interest rates can bite if you’re not careful. More on that soon.

Top Quick Loan App in Nigeria You Should Know About

Now, let’s talk about the big names. Nigeria’s got a ton of loan apps, but some stand out for their reliability, speed, and user love. Here’s my rundown of the top players as of April 2025—based on what’s hot, user reviews, and my own digging. No fluff, just the good stuff!

1. Branch

Branch is like the Oga of quick loan app in Nigeria. With over 10 million downloads, it’s a fan favorite. You can borrow between ₦1,000 and ₦500,000, with repayment terms from 62 days to a year. Interest? It ranges from 3% to 23% monthly, depending on your profile. What’s cool is they don’t just do loans—you can save and invest too. The app’s got a slick interface, and users rave about its 4.5-star rating on Google Play. Downside? Newbies might start with a tiny loan limit, but it grows as you repay on time.

2. Carbon

Carbon (formerly Paylater) is another quick loan app in Nigeria. Licensed by the Central Bank of Nigeria, it’s legit and trusted. Loans go from ₦2,500 to ₦1 million, with interest rates between 4.5% and 30%. Repayment can stretch up to 64 weeks. The app’s got over 5 million downloads and a solid 4.1-star rating. People love the no-collateral vibe and quick disbursements—sometimes in under an hour. But watch out: those higher interest rates can sneak up on you if you’re not prompt with repayments.

3. FairMoney

FairMoney’s a beast when it comes to loan amounts—₦1,500 to ₦3 million! It’s perfect if you need more than pocket change. Repayment terms range from 61 days to 18 months, and interest sits between 2.5% and 21.7% monthly. With over 10 million downloads and a 4.5-star rating, it’s a go-to for fast approvals (think 5 minutes). Bonus: repay early, and you might snag a 90% interest discount. The catch? You need a decent credit score to unlock the bigger sums.

4. QuickCheck

QuickCheck is one of the quick loan app in Nigeria. It’s all about speed and privacy. You can grab up to ₦1 million with interest rates from 2% to 30%, repayable in 30 days to six months. It’s got a 4.5-star rating and over a million downloads. What sets it apart? No third-party debt collectors harassing you—just professional reminders. Users say it’s super user-friendly, but your first loan might be small until you build trust.

5. PalmCredit

PalmCredit’s great for smaller, urgent needs—₦5,000 to ₦300,000, with interest between 4% and 24%. Repayment’s flexible at 91 days to a year. It’s got over 5 million downloads and a 4.2-star rating. People love the no-rollover-fee policy and rewards for referring friends. Heads-up, though: the APR (24% to 56%) can feel steep if you stretch repayment too long.

There are tons more—like Renmoney, Aella Credit, and OKash—but these five are the cream of the crop right now. Each has its flavor, so pick one that fits your vibe and needs.

The Pros of Quick Loan App in Nigeria

Why do Nigerians keep flocking to these apps? Let’s count the ways:

- Speed: Money in minutes? Yes, please! Perfect for emergencies.

- No Collateral: You don’t need to pawn your grandma’s jewelry.

- Convenience: Apply from your couch, in your pajamas, at midnight—whenever!

- Flexibility: Small loan today, bigger one tomorrow as your limit grows.

- Accessibility: No fancy credentials needed—just a phone and ID.

It’s like having a financial safety net in your pocket. When life throws curveballs, these apps catch them—fast.

The Cons of Quick Loan App in Nigeria

But hold up—it’s not all sunshine and rainbows. There are some downsides you’ve gotta watch out for:

- High Interest Rates: That 20% or 30% monthly rate? It adds up quick if you’re late.

- Short Repayment Periods: Some apps want their money back in 15 days—pressure much?

- Debt Traps: Borrow too often, and you’re stuck in a cycle. Yikes!

- Privacy Concerns: Those apps digging through your SMS? Feels a bit invasive, right?

- Harassment: Miss a payment, and some apps might blow up your phone—or worse, your contacts.

The key? Use them smartly. Don’t borrow what you can’t repay, and always read the fine print.

Tips for Using Quick Loan App in Nigeria Like a Pro

Alright, ready to dive in? Here’s how to use these apps without getting burned:

- Borrow Only What You Need: Tempted by that ₦500,000 limit? If you only need ₦20,000, stick to that.

- Check the Interest: Compare rates across apps—2% beats 30% any day.

- Repay on Time: Late fees are brutal, and early repayment can boost your limit.

- Read Reviews: What are other users saying? A 4-star app beats a 2-star one.

- Secure Your Data: Use apps regulated by the CBN or FCCPC to avoid scams.

Treat it like borrowing from a friend—pay back quick, and you’ll stay on good terms.

Are Quick Loan App in Nigeria Safe?

Safety’s a biggie. With stories of rogue apps harassing borrowers, you’re right to wonder. The good news? Many top apps—like Branch, Carbon, and FairMoney—are licensed by the Central Bank of Nigeria and follow FCCPC guidelines. They’re legit and won’t sell your data to sketchy folks.

But there are bad apples out there. Stick to apps with solid ratings, millions of downloads, and clear terms. If it’s asking for weird permissions or promising “free money,” run! And if you’re ever in doubt, Google it or check X for what people are saying.

How to Choose the Best Quick Loan App in Nigeria for You

With so many options, picking the right app can feel like choosing jollof rice at a party—everyone’s got their favorite! Here’s how to narrow it down:

- Loan Amount: Need ₦10,000 or ₦1 million? Match the app to your need.

- Interest Rate: Lower is better—aim for single digits if you can.

- Repayment Period: Short on cash flow? Go for longer terms.

- Speed: If it’s urgent, check disbursement times—minutes matter!

- User Experience: A clunky app is a headache. Pick one that’s smooth and simple.

For example, if you’re after a big loan with low interest, FairMoney’s your guy. Small and quick? PalmCredit’s got you. It’s all about what fits your wallet and vibe.

The Future of Quick Loan App in Nigeria

Where’s this all heading? Fintech’s booming in Nigeria, and quick loan apps are riding the wave. With more people getting smartphones and internet access, these apps are only going to grow. Experts say we might see lower rates, bigger loans, and even AI-driven approvals getting smarter.

But there’s a flip side—regulation’s tightening. The government’s cracking down on shady operators, which is great for us users but might mean fewer apps overall. Either way, quick loans are here to stay, and they’re only getting slicker.

FAQs

QuickCheck is one of the top-rated loan apps in Nigeria, designed for small business owners and individuals who need quick loans without collateral. It is known for its low interest rates, flexible repayment plans, and fast approval process, making it a great option for those who need urgent financial assistance.

Snapcash is a product of Sterling Bank Nigeria. With it you can get instant loans up to ₦50,000. The service is available to both Sterling and non-Sterling Bank customers aged 18 and above

Yes, Moniepoint offers business loans, including working capital and overdrafts, to help businesses grow, with the option to apply online through their website or mobile app.

Conclusion

So, there you have it—the lowdown on quick loan app in Nigeria! They’re fast, they’re convenient, and they can be a lifesaver when you’re in a jam. From Branch’s low rates to FairMoney’s hefty limits, there’s something for everyone. But they’re not perfect—high interest and short repayment windows can trip you up if you’re not careful. My advice? Use them wisely, borrow what you can handle, and always check the terms. Got a favorite app or a tip to share? Drop it in the comments—I’d love to hear your take! Now go tackle that financial hiccup like the boss you are!