What Is a Personal Line of Credit?

A personal line of credit is like a credit card and a loan rolled into one. It’s a pre-approved amount of money you can borrow from a lender, such as a bank or credit union, whenever you need it, up to a certain limit. Unlike a traditional loan, where you get a lump sum upfront and start paying it back immediately, a personal line of credit lets you draw funds as needed. You only pay interest on the amount you actually borrow, not the entire credit limit. This makes it a fantastic option for managing cash flow or handling expenses that pop up unexpectedly.

Think of it like a reusable bucket of money. You can dip into it whenever you need to, refill it by paying back what you borrowed, and dip again later. The flexibility of a personal line of credit makes it ideal for ongoing or unpredictable expenses, like home renovations or medical bills. Plus, since it’s revolving credit, your available credit replenishes as you repay, giving you continuous access to funds as long as the account remains open and in good standing.

How Does a Personal Line of Credit Work?

So, how does this financial tool actually function? When you’re approved for this credit, the lender sets a credit limit based on factors like your credit score, income, and financial history. This limit could range from a few thousand dollars to tens of thousands, depending on your qualifications and the lender’s policies. Once approved, you can access the funds through methods like online transfers, checks, or even a dedicated debit card, depending on the lender.

Here’s the kicker: you don’t have to use the full amount right away—or at all. If you have a $10,000 personal line of credit and only need $2,000 for a car repair, you’ll only borrow and pay interest on that $2,000. Interest rates on personal lines of credit are often variable, meaning they can fluctuate based on market conditions, but they’re typically lower than credit card rates. You’ll make monthly payments on the borrowed amount, and as you pay it back, that money becomes available to borrow again.

One thing to keep in mind: some lenders may charge fees, like an annual fee or a transaction fee for each withdrawal. Always read the fine print to understand the terms before signing up. The beauty of a personal line of credit is its flexibility, but it’s still a financial commitment that requires responsible management.

Personal Line of Credit vs. Other Borrowing Options

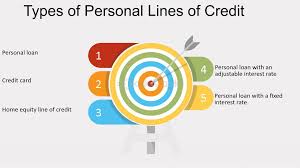

You might be wondering how a personal line of credit stacks up against other borrowing options like credit cards, personal loans, or home equity lines of credit (HELOCs). Let’s break it down.

- Credit Cards: Like a personal line of credit, credit cards offer revolving credit, meaning you can borrow and repay repeatedly up to a limit. However, credit cards often come with higher interest rates, especially if you carry a balance. A personal line of credit usually has lower rates and may offer larger credit limits, making it better for bigger expenses.

- Personal Loans: Personal loans give you a lump sum that you repay in fixed monthly installments over a set term. They’re great for one-time expenses, like buying a car, but lack the flexibility of a personal line of credit. If you don’t need all the money at once, a personal line of credit lets you borrow only what you need, when you need it.

- HELOCs: A home equity line of credit is similar to a personal line of credit but is secured by your home, meaning your property is collateral. This often results in lower interest rates, but it also carries the risk of losing your home if you can’t repay. A personal line of credit is typically unsecured, so there’s no collateral required, though you may need a stronger credit profile to qualify.

Each option has its place, but the personal line of credit shines for its balance of flexibility and affordability, especially for those who want access to funds without tying up their assets.

Who Can Benefit from a Personal Line of Credit?

This line of credit isn’t for everyone, but it can be a game-changer for certain people. If you’re someone who values financial flexibility and has a solid credit history, this could be your go-to tool. Here are a few scenarios where a personal line of credit can make a big difference:

- Homeowners Tackling Renovations: If you’re updating yourkitchen or fixing a leaky roof, costs can add up quickly—and unpredictably. A personal line of credit lets you cover expenses as they arise without taking out a massive loan upfront.

- Small Business Owners: Running a business often means dealing with uneven cash flow. A personal line of credit can help you bridge gaps, whether it’s buying inventory or covering payroll during a slow month.

- Debt Consolidators: If you’re juggling high-interest credit card debt, a personal line of credit can help you consolidate those balances into one lower-interest payment, saving you money over time.

- Emergency Planners: Life is full of surprises, and not all of them are pleasant. A personal line of credit can act as a financial cushion for unexpected medical bills, car repairs, or other emergencies.

That said, a personal line of credit is best for those who are disciplined with their finances. Since it’s easy to borrow, it can be tempting to overspend. If you’re not confident in your ability to repay what you borrow, you might want to explore other options.

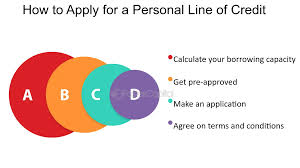

How to Qualify for a Personal Line of Credit

Qualifying for this credit isn’t as daunting as it might seem, but lenders do have standards. Here’s what they typically look for:

- Good Credit Score: Most lenders prefer a credit score of 680 or higher, though some may accept lower scores with higher interest rates. A strong credit history shows you’re reliable at paying back debt.

- Stable Income: Lenders want to see that you have a steady income to cover repayments. You’ll likely need to provide proof, like pay stubs or tax returns.

- Low Debt-to-Income Ratio: This measures how much of your income goes toward debt payments. A lower ratio (typically below 40%) signals that you can handle additional borrowing.

- Banking Relationship: Some banks and credit unions offer better terms to existing customers, so it might help to apply with an institution where you already have an account.

The application process is usually straightforward. You’ll submit an application with details about your finances, and the lender will review your credit and income. If approved, you’ll get your credit limit and terms, and you can start using the funds right away. Shopping around for the best rates and terms can save you money, so don’t settle for the first offer you get.

Tips for Using a Personal Line of Credit Wisely

This line of credit is a powerful tool, but like any tool, it needs to be used carefully. Here are some tips to make the most of it without falling into a debt trap:

- Borrow Only What You Need: Just because you have access to $20,000 doesn’t mean you should use it all. Stick to borrowing only what’s necessary to avoid racking up interest.

- Have a Repayment Plan: Before you borrow, know how you’ll pay it back. Set a budget to ensure you can cover monthly payments without straining your finances.

- Monitor Interest Rates: Since many personal lines of credit have variable rates, keep an eye on market trends. If rates rise, your payments could increase, so plan accordingly.

- Avoid Using It for Everyday Expenses: It isn’t meant for daily spending like groceries or gas. Save it for larger, planned expenses or emergencies.

- Pay More Than the Minimum: Paying only the minimum keeps you in debt longer and costs more in interest. Whenever possible, pay extra to reduce your balance faster.

By treating your personal line of credit as a strategic resource rather than a free-for-all, you can enjoy its benefits without the stress of mounting debt.

- How to borrow money from Cash App

- How to apply for a home equity loan

- Personal loan for debt consolidation

Pros and Cons of a Personal Line of Credit

Pros

- Flexibility: Borrow as much or as little as you need, when you need it, without reapplying.

- Lower Interest Rates: Compared to credit cards, personal lines of credit often have more affordable rates.

- Revolving Credit: As you repay, your available credit replenishes, giving you ongoing access to funds.

- No Collateral Required: Most personal lines of credit are unsecured, so you don’t risk losing assets.

Cons

- Variable Rates: Interest rates can fluctuate, making it harder to predict payments.

- Fees: Some lenders charge annual fees, withdrawal fees, or inactivity fees.

- Temptation to Overspend: Easy access to funds can lead to borrowing more than you can repay.

- Credit Requirements: You’ll need good credit to qualify for the best terms, which may exclude some borrowers.

Understanding these pros and cons can help you decide whether this line of credit aligns with your financial goals and habits.

Common Uses for a Personal Line of Credit

Wondering how people actually use a personal line of credit? The possibilities are nearly endless, but here are some of the most common ways it comes in handy:

- Home Improvements: Whether it’s a new deck or a bathroom remodel, this line of credit can cover costs as they come up, without the need for a large upfront loan.

- Medical Expenses: Unexpected medical bills can derail your budget. A personal line of credit provides quick access to funds for doctor visits, surgeries, or dental work.

- Debt Consolidation: Pay off high-interest credit cards or loans with a lower-rate personal line of credit to simplify your payments and save on interest.

- Education Costs: Cover tuition, books, or other education-related expenses for yourself or a family member.

- Travel and Leisure: Fund a dream vacation or special event without dipping into savings or maxing out credit cards.

The key is to use this credit for purposeful, planned expenses rather than impulse purchases. This ensures you’re borrowing with intention and can repay comfortably.

FAQ

Personal lines of credit typically have a draw period and a repayment period. During the draw period you can use your personal line of credit to make purchases directly or to withdraw cash. Once the repayment period starts, you no longer have access to your credit limit.

Once approved for a line of credit, you’re in the draw period and can use the funds as often as you want. The draw period can last two to five years. During this time, you’ll receive a monthly bill that shows any advances, payments, interest and fees.

To access money from your line of credit, you may: write a cheque from your line of credit. use an automated teller machine (ATM) pay a bill using telephone or online banking.

A line of credit lets you borrow money up to a limit, pay it back, and borrow again.

How to Find the Best Personal Line of Credit

Not all personal lines of credit are created equal, so it pays to shop around. Here’s how to find the best one for your needs:

- Compare Interest Rates: Look for the lowest possible rate, but also check whether it’s fixed or variable. A fixed rate offers predictability, while a variable rate might start lower but could rise.

- Check for Fees: Some lenders charge annual fees, transaction fees, or penalties for inactivity. Opt for a line of credit with minimal or no fees if possible.

- Read Reviews: Look up customer reviews to see how lenders handle things like customer service, ease of access, and transparency.

- Consider Online Lenders: In addition to traditional banks and credit unions, online lenders often offer competitive rates and faster approval processes.

- Ask About Terms: Understand the repayment schedule, credit limit, and any restrictions on how you can use the funds.

Taking the time to research and compare options can save you money and ensure you get a personal line of credit that fits your lifestyle.

Myths About Personal Lines of Credit

There are some misconceptions floating around about personal lines of credit that might make you hesitant to consider one. Let’s clear up a few:

- Myth: It’s Just Like a Credit Card: While both offer revolving credit, a personal line of credit often has lower interest rates and higher limits, making it better for larger expenses.

- Myth: You Need Perfect Credit: While good credit helps, some lenders offer personal lines of credit to borrowers with fair credit, though terms may be less favorable.

- Myth: It’s Only for Emergencies: This credit can be used for planned expenses like home improvements or debt consolidation, not just unexpected costs.

- Myth: It’s Hard to Get Approved: If you have a decent credit score and stable income, qualifying is often easier than you think, especially with online lenders.

By separating fact from fiction, you can make an informed decision about whether a personal line of credit is right for you.

Conclusion

A personal line of credit can be a financial lifeline, offering the flexibility to handle life’s ups and downs without the stress of rigid loan terms or sky-high interest rates. Whether you’re planning a major purchase, consolidating debt, or preparing for the unexpected, this tool gives you the freedom to borrow on your terms. Just remember to use it wisely—borrow only what you need, have a repayment plan, and keep an eye on rates and fees. By understanding how a personal line of credit works and choosing the right one for your needs, you can unlock a world of financial possibilities. So, why not explore your options and see how this credit can empower you to take control of your finances?