When it comes to funding higher education, it is important to know the Mohela student loan interest rate. Student loans play a key role, and understanding their interest rates may make a major impact on long-term financial planning. One of the primary stakeholders in student loan servicing is MOHELA—the Missouri Higher Education Loan Authority. MOHELA is a well-known student loan servicer that helps borrowers manage their federal and, in certain situations, private student loans.

Knowing how interest rates operate is vital since they affect how much you’ll pay throughout the life of your loan. A high interest rate can add thousands of dollars to your debt, while a lower rate might make payments more feasible. In this post, we’ll explain all you need to know about MOHELA student loan interest rates, how they operate, and how you may lower your total payments.

Types of MOHELA Student Loans

MOHELA primarily serves federal student loans; however, it may also manage some private loans. Here’s an overview of the sorts of loans MOHELA services:

Federal Student Loans Serviced by MOHELA

Federal student loans come with fixed interest rates established by the government. MOHELA does not determine these rates but works as the servicer to assist you handle payments. Some of the most frequent federal student loans include:

- Direct Subsidised Loans: These are available to undergraduate students with financial need. Interest does not accumulate while you’re in school or during deferral periods.

- Direct Unsubsidised Loans: These are available to both undergraduate and graduate students, but interest starts collecting immediately.

- Direct PLUS Loans: Designed for graduate students or parents of dependent undergraduate students. These loans frequently have higher interest rates.

- Direct Consolidation Loans: These allow you to combine numerous federal student loans into one, with a weighted average interest rate.

Private Student Loans (If Applicable)

MOHELA may also manage private student loans, however these loans are granted by banks, credit unions, or other private lenders. Private student loan interest rates can vary greatly and are generally depending on creditworthiness and market conditions.

MOHELA Student Loan Interest Rate

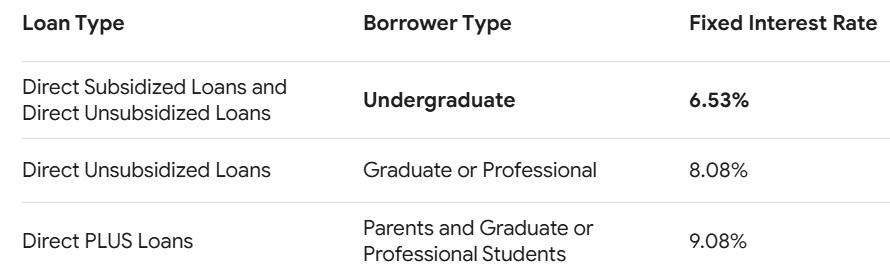

Current Interest Rates for Federal Student Loans

Federal student loan interest rates are established by the U.S. Department of Education each year. Here are the latest rates:

- Direct Subsidized Loans (Undergraduates): Typically approximately 5-6%

- Direct Unsubsidized Loans (Undergraduates): Similar to subsidized rates

- Direct Unsubsidized Loans (Graduates): Usually approximately 6-7%

- Direct PLUS Loans: Often 7-8%

These prices fluctuate annually, so it’s crucial to check for the newest changes.

How Interest Rates Are Determined

Federal student loan interest rates are based on the 10-year Treasury note plus a predetermined percentage. Congress determines this formula, and rates are changed annually in July.

Fixed vs. Variable Interest Rates

Fixed Interest Rates: Stay the same throughout the loan period, giving predictable monthly payments.

- Variable Interest Rates: Change over time, either decreasing or raising your monthly payment. These are often encountered in private loans.

Factors Influencing Mohela student loan interest rate

Federal Loan Policies and Market Conditions

For federal loans, interest rates are determined by government policy and economic conditions. The government modifies rates yearly based on financial markets.

Borrower Creditworthiness (For Private Loans)

Unlike federal loans, private student loan interest rates rely on factors including your credit score, income, and repayment history. Borrowers with stronger credit scores frequently obtain reduced interest rates.

Loan Type and Repayment Plan

- Direct Subsidized vs. Unsubsidized Loans: Subsidized loans tend to be more borrower-friendly because they don’t accumulate interest while in school.

- Income-Driven Repayment Plans: Some plans change your payments based on your income, which might influence overall interest charges.

Interest Accrual and Capitalization

How Interest Accrues on Student Loans

Interest on student loans accrues daily based on the outstanding principle balance. For example, if you owe $10,000 with a 5% interest rate, you’ll accrue around $1.37 every day in interest.

Interest Capitalization and Its Impact on Total Repayment

When unpaid interest is added to the principal debt, it is termed capitalization. This can considerably raise the overall amount you owe. Interest capitalisation commonly occurs:

- After deferred or forbearance periods

- When altering repayment arrangements

- If payments are missing

Mohela student loan interest rate: Managing and Reducing Interest Costs

Interest Rate Reductions and Discounts

- Autopay Discounts: Some lenders, like MOHELA, provide 0.25% interest rate discounts for setting up automatic payments.

- On-time Payment Discounts: Some private lenders reward borrowers for continuous payments.

Income-Driven Repayment Plans

Federal debtors can qualify for income-driven repayment (IDR) plans, which alter monthly payments depending on income. These arrangements may help minimise the overall interest paid over time.

Loan Consolidation and Refinancing Options

- Federal Loan Consolidation: Combines various federal loans into one with a weighted average interest rate.

- Refinancing with a Private Lender: This may lead to a reduced interest rate, but you’ll lose federal safeguards including income-driven repayment and debt forgiveness alternatives.

Frequently Asked Questions

How Interest Is Calculated. A daily interest formula determines the amount of interest that accrues (adds up) on your loan each day. This formula consists of multiplying your loan balance by the number of days since you made your last payment and multiplying that result by the interest rate factor.

Conclusion

Understanding MOHELA student loan interest rates is vital for managing your student debt properly. Federal loan rates are controlled by the government, whereas private lending rates rely on credit and market variables. Interest accrual and capitalization can dramatically affect how much you repay, but solutions like autopay discounts, income-driven repayment programs, and refinancing can help minimise expenses.

By keeping educated and researching repayment choices, borrowers may make good financial decisions and decrease the burden of student loan debt. For further specialised assistance, borrowers should contact out to MOHELA or investigate government services such as studentaid.gov.