Overview of Loan App in Nigeria

If you’re in Nigeria and ever found yourself in a financial pinch, you’ve probably heard about loan apps. These little digital miracles have taken the country by storm, offering quick, hassle-free cash when you need it most. No long queues at the bank, no endless paperwork—just a few taps on your phone, and boom, money in your account! But with so many options popping up, how do you know which loan app is right for you? Don’t worry—I’ve got you covered. In this deep dive, we’ll explore everything you need to know about loan app in Nigeria: what they are, how they work, the best ones to try, and some insider tips to keep you out of trouble. Let’s get started!

What Are Loan Apps, Anyway?

So, what’s the deal with the loan app? Simply put, they’re mobile applications that let you borrow money instantly without stepping foot in a traditional bank. Think of them as your pocket-sized financial buddy. Whether it’s an emergency medical bill, a business idea you want to jump on, or just rent that’s due tomorrow, these apps are designed to bridge the gap. In Nigeria, where fintech is booming, loan apps have become a lifeline for millions—especially since the banking process can feel like running a marathon with weights tied to your legs.

The beauty of these apps lies in their simplicity. You download one from the Google Play Store or Apple Store, sign up with some basic info (like your BVN—more on that later), and request a loan. If approved, the cash hits your account faster than you can say “naira.” Most of these apps don’t even ask for collateral, which is a game-changer for folks who don’t have assets to pledge. But here’s the catch: convenience comes with a price—usually in the form of interest rates—so you’ve got to be smart about it.

Why is the Loan App in Nigeria So Popular?

Let’s be real: Nigeria’s economy can be a rollercoaster. Inflation’s up one day, the naira’s down the next, and salaries don’t always stretch as far as we’d like. That’s where loan app swoop in like superheroes. They’ve exploded in popularity because they’re fast, accessible, and don’t care if you’re a big shot or just a hustler trying to make ends meet. With over 50% of Nigerians now using smartphones and internet penetration growing, it’s no surprise that digital lending is thriving.

Another reason? Traditional banks can be a headache. You’ve got to dress up, dodge traffic, and sit through endless interrogations just to hear “come back next week”. Loan app cut through all that nonsense. Plus, Nigeria’s youthful population—full of entrepreneurs and dreamers—loves the idea of instant funding for their next big move. Whether it’s a student needing cash for school fees or a trader restocking inventory, these apps are filling a massive gap.

How Does the Loan App in Nigeria Work?

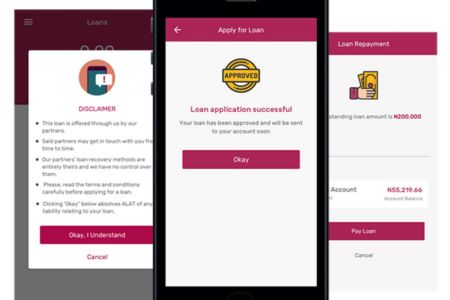

Okay, let’s break it down. Using a loan app is pretty straightforward, but there’s a bit of magic behind the scenes. First, you pick an app—say, Carbon or FairMoney—and download it. Once it’s on your phone, you’ll need to register. This usually means entering your phone number, email, and Bank Verification Number (BVN). The BVN is key because it’s how these apps check your identity and credit history. No BVN? No loan—it’s that simple.

After signing up, you’ll fill out a quick form: how much you want, how long you need it for, and maybe some details about your income. The app’s algorithm (fancy tech stuff) then decides if you’re good for the money. Some apps even use your phone data—like call logs or transaction history—to figure out if you’re reliable. If you pass the test, you’ll get an offer: “Here’s ₦50,000 at 10% interest, repay in 30 days.” Accept it, and the cash lands in your bank account, often within minutes.

Repayment’s the next step. Most apps let you pay back through bank cards, USSD codes, or direct transfers. Miss a payment, though? That’s when things get dicey—late fees pile up, and some apps might even send you not-so-friendly reminders. So, rule number one: only borrow what you can pay back.

The Top Loan App in Nigeria You Should Know About

Now, let’s talk about the heavy hitters. Nigeria’s loan app scene is packed with options, but some stand out for their reliability, speed, and user-friendliness. Here’s my rundown of the top players—based on what’s buzzing out there and what people are saying.

1. Carbon: The OG of Loan Apps

Carbon (formerly Paylater) is like the granddaddy of loan apps in Nigeria. Backed by Carbon Microfinance Bank and regulated by the Central Bank of Nigeria (CBN), it’s got street cred. You can borrow anything from ₦1,500 to ₦1 million, depending on your credit score. Interest rates hover between 5% and 15%, which isn’t too shabby compared to some others. What I love? It’s super fast—approval takes minutes—and you don’t need collateral. Plus, paying back on time boosts your limit for next time. It’s a solid pick if you’re just starting out.

2. FairMoney: The Speed King

FairMoney’s got over 10 million downloads, and for good reason—it’s lightning-quick. Need ₦500,000 in five minutes? This app’s got your back. Interest rates range from 5% to 28%, depending on the amount and repayment period (usually 61 days to 6 months). It’s CBN-approved, so you’re not dealing with shady characters. FairMoney also offers bigger loans as you build trust with them. If speed’s your thing, this one’s a no-brainer.

3. Branch: The Global Player

Branch is another big name, with a massive user base in Nigeria. You can grab between ₦2,000 and ₦500,000, with repayment terms from 61 to 180 days. Interest rates sit between 14% and 28%, which is fair for the convenience. What sets Branch apart? It’s got a sleek app and doesn’t drown you in paperwork. It’s perfect for personal cash needs—like fixing your car or covering a sudden expense.

4. PalmCredit: The Small-Loan Specialist

If you’re after something smaller, PalmCredit’s your guy. Loans max out at ₦100,000, with interest rates between 14% and 24%. Repayment’s flexible, from 14 days to 180 days. It’s owned by Transsnet Financial Nigeria Ltd., and it’s got a rep for being user-friendly. Great for quick fixes—like buying data or settling a utility bill.

5. Renmoney: The Big Bucks Option

Renmoney’s for those who need serious cash—up to ₦6 million! It’s a microfinance bank, so it’s legit, and repayment can stretch up to 730 days. You’ll need a bank statement and ID, but the process is still smoother than a bank’s. Interest rates vary, but they’re competitive. If you’re funding a business or a big project, Renmoney’s worth a look.

The Pros of Using a Loan App in Nigeria

Why should you even bother with these apps? Well, they’ve got some serious perks. For starters, they’re fast—way faster than waiting on a bank loan. Need cash today? You’ve got it. They’re also accessible—pretty much anyone with a smartphone and BVN can apply. No collateral means you don’t have to risk your car or house, which is a huge relief.

Then there’s the flexibility. Whether you need ₦5,000 or ₦5 million, there’s an app for that. Repayment terms vary too, so you can pick what fits your budget. And let’s not forget the empowerment factor—small business owners, students, and everyday hustlers are using these apps to chase their dreams. It’s like having a financial safety net in your pocket.

The Downsides You Can’t Ignore

But hold up—it’s not all sunshine and rainbows. Loan apps have their dark side. Interest rates can be steep—sometimes higher than traditional loans. Miss a payment, and those late fees stack up quick. Some apps even get aggressive with debt collection, spamming your contacts with messages (yikes!). And if you’re not careful, you could end up in a debt spiral—borrowing to pay off borrowing.

There’s also the scam factor. Not every app is legit—some are fly-by-night operations looking to steal your data or money. That’s why sticking to CBN-approved apps is clutch. Oh, and privacy? Your BVN and phone data give these apps a lot of insight into your life, so trust matters.

Tips for Using a Loan App in Nigeria Like a Pro

Want to make the most of loan apps without getting burned? Here’s my advice:

- Only Borrow What You Need: It’s tempting to grab the max, but keep it real. Can you pay it back? If not, scale down.

- Check the Interest Rate: Compare apps before you commit. A few extra percent can mean a lot over time.

- Read the Fine Print: Those terms and conditions? They’re not just decoration. Know what you’re signing up for.

- Pay on Time: Late payments are a trap—avoid them like the plague. Set reminders if you have to.

- Stick to Trusted Apps: Go for names like Carbon, FairMoney, or Branch. Check reviews and CBN approval.

- Have a Plan: Don’t borrow just because—it’s gotta solve a problem or move you forward.

How Loan App is Changing Nigeria’s Financial Game

Let’s zoom out for a sec. Loan apps aren’t just a trend—they’re reshaping how Nigerians handle money. Fintech’s giving power back to the people, cutting out middlemen and bureaucracy. Small businesses are growing, students are staying in school, and emergencies aren’t turning into disasters. It’s financial inclusion in action—bringing millions into the system who’d otherwise be left out.

But it’s not perfect. The government’s cracking down on shady apps, and the CBN’s tightening regulations to protect users. That’s good news—it means the legit players can thrive while the scammers get weeded out. Still, it’s a wild west out there, and staying savvy is key.

Picking the Right Loan App in Nigeria for You

So, which app’s your match? It depends on what you’re after. Need a small, quick loan? PalmCredit or FairMoney’s your vibe. Got a big project? Renmoney’s got the muscle. Want something reliable with a track record? Carbon or Branch won’t steer you wrong. Think about your budget, how fast you need the cash, and how long you can take to pay it back. Then test the waters—most apps let you start small.

The Future of Loan App in Nigeria

What’s next? I’d bet on more growth. As internet access spreads and smartphones get cheaper, loan apps will reach even more Nigerians. AI’s already making approvals smarter, and we might see lower rates as competition heats up. But with growth comes responsibility—users need education on borrowing wisely, and apps need to keep things ethical. The future’s bright, but it’s up to us to keep it smart.

FAQs

Branch is another reliable loan app that allows you to receive up to N200,000 worth within 24 hours with a minimal amount of N1000. Repayment is within 4 to 40 weeks and the loan attracts varying interest rates depending on the amount of the loan and the user’s repayment history.

Renmoney: Renmoney has been around for a while and has a good reputation among lenders. …

Page Financials: Page Financials is another online lender with a history. …

Zitra Investments: Although Zitra Investments is the “new kid on the block”, the management team has acknowledgable experience in Finance.

Yes, OPay offers a loan service called OKash, which provides short-term loans to customers, and also has a merchant loan feature for businesses.

Conclusion: Your Loan App Adventure Awaits

There you have it—your crash course on the loan app in Nigeria! These apps are a lifeline when cash is tight, offering speed and convenience banks can’t touch. From Carbon’s reliability to Renmoney’s big loans, there’s something for everyone. Just play it smart—borrow what you can handle, stick to legit apps, and always have a payback plan. Ready to dive in? Pick an app, tap that download button, and take control of your finances. What’s your next move? Let me know—I’m all ears!