How to apply for a home equity loan is faster and easier than you think. So, if you’re seeking to tap into your home’s value and secure some additional cash, a home equity loan might be the perfect solution. Whether you want to fund a home renovation, consolidate debt, or cover unexpected expenses, this type of loan can offer competitive interest rates and flexible terms. But how do you go about applying for one? Let’s explain it in basic terms so you can confidently navigate the process.

What is Home Equity Loan?

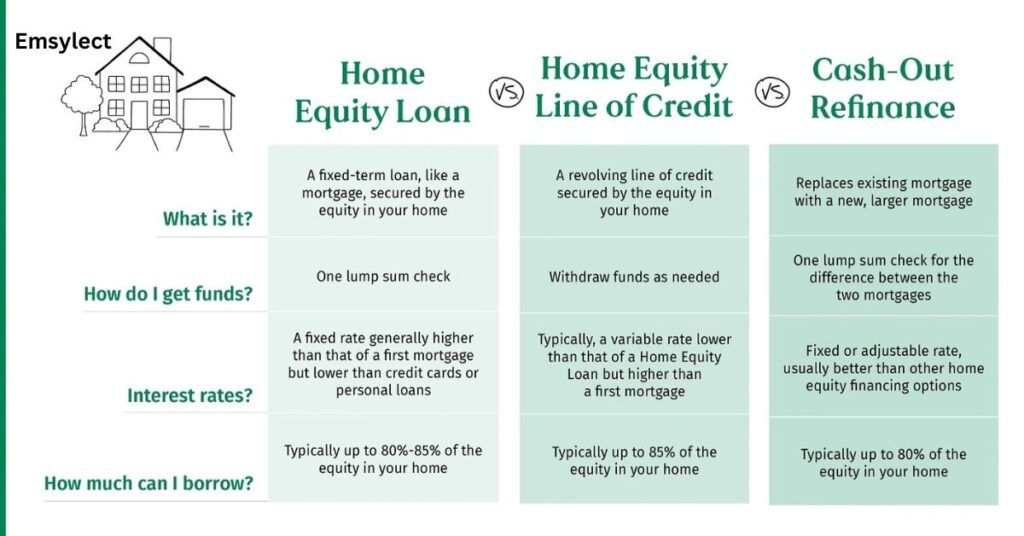

A home equity loan, sometimes termed a second mortgage, allows you to borrow money against the equity in your property. Equity is the difference between your home’s market value and what you still owe on your mortgage. Lenders typically allow householders to borrow up to 85% of their equity, depending on their creditworthiness and financial situation.

HOW TO APPLY FOR A HOME EQUITY LOAN

Step 1: Determine Your Home Equity

Before you submit, you need to work out how much equity you have. Here’s a simple formula to compute it:

Home’s Market Value – Mortgage Balance = Home Equity

For example, if your property is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity. Most lenders will enable you to borrow a percentage of that equity, so it’s crucial to know your numbers upfront.

Step 2: Check Your Credit Score

Your credit score plays a crucial role in determining your eligibility and interest rate. Most lenders require a score of at least 620, but a higher score (700 or above) can secure you better terms. If your score needs improvement, take time to pay down debts and make punctual payments before applying.

Step 3: Assess Your Finances

Lenders will scrutinize your income, debts, and overall financial health to ensure you can afford another loan. They will calculate your debt-to-income (DTI) ratio, which is the percentage of your income that goes toward paying debts. A lesser DTI (below 43%) increases your odds of approval.

Step 4: Research Lenders and Loan Options

Not all lenders offer the same terms, so it’s wise to shop around. Compare interest rates, loan terms, and fees from different banks, credit unions, and online lenders. Some lenders may offer benefits like lower closing costs or flexible repayment options.

Step 5: Gather Required Documents

To speed up the application procedure, prepare the necessary documentation in advance. Lenders typically require:

Proof of income (pay receipts, tax returns, or bank statements)

Step 6: Submit Your Application

Once you’ve chosen a lender, it’s time to complete the application. You can typically enroll online, over the phone, or in person. Be honest and meticulous when providing information to avoid delays.

Step 7: Wait for Approval and Underwriting

After submitting your application, the lender will examine your financials, verify your documents, and possibly conduct a home appraisal. This process can take anywhere from a few days to a few weeks. Stay patient and be prepared to provide additional information if requested.

Step 8: Review the Loan Terms

If you’re approved, the lender will present you with a loan agreement delineating the provisions, including:

- Loan quantity

- Interest rate (fixed or variable)

- Repayment period

- Monthly payment sum

- Any fees or closing expenditures

Review everything attentively and ask questions if something isn’t obvious. Make sure you’re comfortable with the terms before registering.

Step 9: Close the Loan

Once you approve the loan terms, you’ll schedule a closing appointment. During closing, you’ll sign all necessary documents and pay any applicable fees. After closing, you’ll receive your funds—typically via direct deposit or check.

Step 10: Start Repaying the Loan

Your first payment will usually be due within 30-60 days. Set up automatic payments or reminders to ensure you stay on track. Missing payments can result in penalties and even foreclosure, so prioritize timely payments.

CONCLUSION

Applying for a home equity loan doesn’t have to be complicated. By comprehending the process, verifying your financial health, and comparing lenders, you can secure a loan that meets your needs. Whether you’re renovating your home or tackling high-interest debt, using your home’s equity judiciously can be a savvy financial move. Take your time, do your research, and make informed decisions to set yourself up for success!