FHA Loan Requirements nc — If the notion of a huge down payment or a pristine credit score has you sweating, let me introduce you to your new best friend: the FHA loan. Backed by the Federal Housing Administration, these loans are like a hidden weapon for first-time purchasers, those with so-so credit, or anyone who’s not sitting on a lot of cash. But before you start imagining yourself barbecuing in the backyard, you’ve got to grasp the rules of the game. Don’t worry—I’m here to lay down every single FHA loan requirements nc in a way that’s easy to comprehend, with some real talk and pro recommendations tossed in. By the conclusion of this, you’ll be ready to handle homeownership like a champ. Let’s get started!

What’s an FHA Loan, Anyway?

Picture this: you’re at a bank, hat in hand, asking for a mortgage, and they’re side-eyeing your credit score like it’s a lousy Tinder bio. That’s where the FHA swoops in to rescue the day. An FHA loan isn’t handed out by the government itself—it’s supplied by private lenders like your local credit union or that large bank down the street. The twist? The Federal Housing Administration guarantees it, which is like a safety net for the lender. If you skip a payment (let’s hope not!), they’re not entirely sunk. That insurance is why they’re fine with breaking the rules a bit compared to those rigid traditional loans.

Why should you care? Because FHA loans imply smaller down payments, milder credit requirements, and interest rates that won’t make you weep. They’re created for average folks—people like you and me who might not have a trust fund or a six-figure job. But to nab one, you’ve needed to check a few boxes. Let’s walk through them one by one.

Credit Score: No Perfect Record Needed

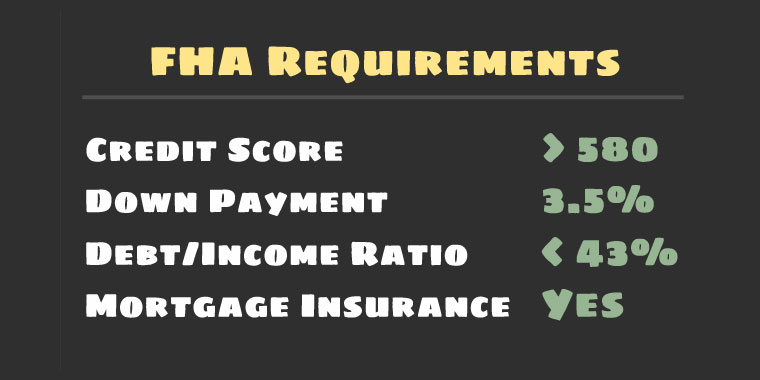

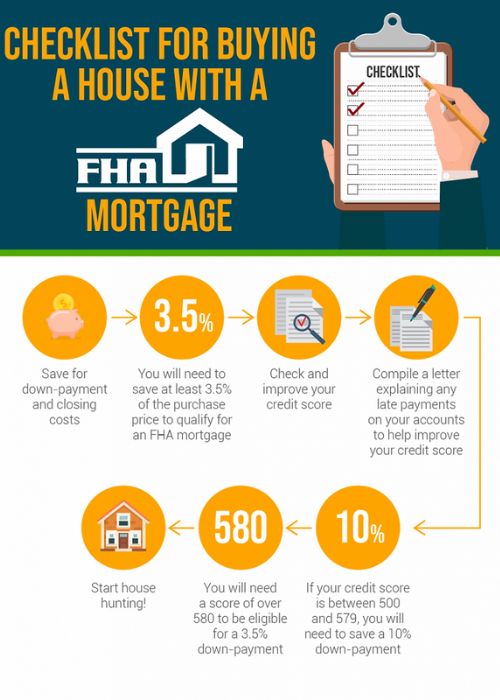

Let’s begin things off with the big one: your credit score. I know, just hearing “credit score” may make your stomach flip, especially if you’ve had a few dings on your report. But here’s the beauty of an FHA loan—you don’t need to be a financial saint to qualify. The minimum score depends on how much you’re putting down. If you can cobble together 3.5% of the home’s price for a down payment, you’re good with a credit score of 580 or better. That’s right—580! For background, traditional loans frequently require 620 or more, so this is a major victory.

What if your score’s a little shakier, say between 500 and 579? You’re still in the game, but you’ll need to bring a 10% down payment to the table. Below 500? Sorry, friend—you’ll need to pump the brakes and work on that score first. Don’t panic, though. Boosting it isn’t rocket science. Pay down some credit card bills, contest any inaccuracies on your record, or even urge a landlord to disclose your rent payments if they don’t already. Little actions like those can tip you over the 580 lines sooner than you realize.

Real-life example: my buddy Jake had a 590 score after a hard spell with medical costs. He spent six months paying off a little debt and bam—his score hit 582. With an FHA loan, he was moving into his new apartment by spring. Moral of the story? You’ve got alternatives, even if your credit’s not picture-perfect.

Down Payment: Less Cash Upfront

Now, let’s talk cash—or the lack of it. One of the largest challenges to buying a house is the down payment. Conventional loans could require 20%—on a $250,000 property, that’s $50,000! Who’s got that lying around? With an FHA loan, you’re looking at just 3.5% if your score is 580 or above. For the same $250,000 residence, that’s $8,750. I don’t know about you, but I’d much rather cobble together eight grand than fifty.

Here’s where it gets even sweeter: that 3.5% doesn’t have to be all yours. The FHA’s cool with gift funds—think Mom, Dad, your kind aunt, or even a close friend sending you a check. My cousin Sarah got her down payment as a wedding gift from her in-laws, and it worked like a charm. You might also look into down payment assistance programs—tons of states and towns provide grants or low-interest loans to aid first-timers. Just google “down payment help [your state]” and see what jumps up.

One catch: the money’s got to be authentic. Lenders demand a paper trail—gift letters, bank statements, the whole. No shoving cash in a mattress and calling it a day. Keep things above board, and you’re set.

FAQs

Credit score: The lowest credit score that will qualify you for an FHA loan is 500. You’ll need a larger down payment if it’s below 580: 10% down versus 3.5% down. Debt-to-income ratio: In general, you need a debt-to-income ratio of no more than 43%. That’s calculated by dividing your total debt by your pre-tax income.

An FHA loan requires a minimum 3.5% down payment for credit scores of 580 and higher. If you can make a 10% down payment, your credit score can be in the 500 – 579 range. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans.

Debt-to-Income Ratio: Keeping Your Finances in Check

Alright, time to dive into the nitty-gritty: your debt-to-income ratio, or DTI. This is how lenders work out if you can handle a mortgage with your other payments. It’s basic math—take all your monthly debt payments (vehicle, school loans, credit cards) plus your potential home payment, and divide that by your total monthly income (before taxes). Multiply by 100, and that’s your DTI %.

For FHA loans, they normally restrict it to 43%. So, if you make $4,000 a month, your total debt—including the mortgage—shouldn’t reach $1,720. Easy, right? Well, sometimes. If you’ve got a vehicle payment, college debt, and a mortgage in the mix, it can add up fast. But here’s a little wriggle room: some lenders may stretch it to 50% if you’ve got a great credit score or extra money stored away.

Let me paint you a picture. Say you’ve got $300 in school debt plus a $200 vehicle payment—that’s $500. Your income is $4,000, therefore 43% is $1,720. That leaves $1,220 for your mortgage, taxes, and insurance. If it meets your budget, you’re golden. If not, maybe pay off that minor credit card debt to free up some space. I did this before buying my place—knocked off a $1,000 amount, and suddenly my DTI looked a lot nicer.

FHA Loan Requirements nc—Employment History

Lenders aren’t simply inquisitive about your credit—they want to know you’ve got consistent work. For an FHA loan, you need two years of steady job history. Don’t worry if you’ve shifted jobs—no one’s expecting you to be a corporate lifer. They just want to see you’ve been earning regularly, whether it’s at one location or five.

If you’re self-employed or freelancing, it’s a bit difficult but absolutely achievable. You’ll need two years of tax returns indicating solid income. My buddy Mia operates a modest Etsy business and is qualified with her sales records—proof you don’t need a 9-to-5 to make it work. Gaps in employment? Explain them. Maybe you took a year off to travel or had a baby—lenders just want the narrative behind it.

Here’s a fun fact: if you’re fresh out of school or the military, they could cut you some slack. Show them your degree or discharge documents, and they’ll frequently count it toward your past. It’s all about showing you’ve got cash flowing into service that mortgage.

Property Requirements: The House Has to Pass Muster

Now, here’s a twist—it’s not just you that’s had to qualify. The home does too. FHA loans come with property criteria to make sure you’re not buying a money trap. Think of it as a house inspection with a purpose: the place has to be safe, structurally sound, and habitable. No decaying foundations, no big holes in the ceiling, no electrical hookups that scream “fire hazard.”

An FHA-approved appraiser will check it out before you close. They’re not there to critique your choice in countertops—they’re looking for important stuff like functional plumbing, a strong roof, and no lead paint risks (particularly in older homes). I once looked at a nice cottage, but the appraiser noticed a rickety stairway. The vendor corrected it, and we were set to go.

If the place needs work, don’t dump it yet. Minor improvements may frequently be performed before closing, or you can use an FHA 203(k) loan to incorporate repair expenses into your mortgage. My neighbor used one to renovate a kitchen—it’s like receiving a loan and a reno budget in one swoop. Just note: FHA loans are for primary residences only. No beach houses or Airbnb ventures here—you’ve got to live in it.

FHA Loan Requirements nc—Mortgage Insurance

Let’s speak about the not-so-fun part: mortgage insurance. Since FHA loans take on riskier applicants, they require insurance to safeguard the lender. You’ll pay for two types. First, the upfront mortgage insurance payment (UFMIP) is 1.75% of your loan amount—on a $200,000 loan, that’s $3,500. Don’t have it upfront? No sweat—you may roll it into your loan and pay it down over time.

Then there’s the yearly mortgage insurance fee (MIP), which comes down to a monthly portion. It’s normally 0.45% to 1.05% of the loan every year, depending on your conditions. For the $200,000 debt, it’s $75–$175 a month. Here’s the deal: if you put down less than 10%, you’re stuck with MIP for the life of the loan. Put down 10% or more, and it drops off after 11 years. It’s a trade-off—lower admission fee now, but a bit extra each month.

I understand it—nobody enjoys fees. But this is what makes FHA loans accessible for those who’d otherwise be stuck renting. Think of it as the price of entrance to homeownership.

FHA Loan Requirements nc—Loan Limits

Before you start salivating over that big property, let’s talk about limitations. FHA loans restrict how much you may borrow, and it depends on where you reside. In 2025, the baseline for a single-family home is roughly $498,257 in most places. But in high-cost areas—think San Francisco or Manhattan—it may soar to $1,149,825. These statistics fluctuate yearly depending on local house values, so check the FHA’s webpage or bug your lender for the latest in your zip code.

Why the ceiling? The FHA’s objective is affordable housing, not supporting McMansions. Still, those greater restrictions in pricier areas mean you’re not trapped with a shoebox. My sister in LA secured a condo just under the limit—it’s little but hers, and that’s what counts.

Citizenship and Residency: Who Can Apply?

Good news for non-U.S. citizens: you don’t need a passport with stars and stripes to secure an FHA loan. If you’re a lawful permanent resident—like a green card holder—with a valid Social Security number, you’re in. Non-permanent residents with work visas can qualify too, as long as they’ve got the papers to back it up. It’s a huge embrace from the FHA to those creating a life here.

The line in the sand? If you’re undocumented, FHA loans aren’t an option. Lenders need to check your legal status—no exceptions. But for everyone else, it’s an open door.

Bankruptcy and Foreclosure: Second Chances Are Real

Life may deliver curveballs—bankruptcy, foreclosure, you name it. If you’ve been there, don’t count yourself out. For a Chapter 7 bankruptcy, the FHA needs two years from the discharge date before you apply. Hit a severe hurdle like a job loss? Some lenders could decrease that to one year if you’ve improved your credit subsequently. Chapter 13 is more friendlier—you can apply after one year of on-time payments, with court permission.

Foreclosures take a bit longer—three years from the final date. I know a guy who lost his house in the 2008 recession, waited it out, and bought it again with an FHA loan. Lenders don’t worry about your history as much as your present—show them you’re back on track with consistent payments and a solid job, and they’ll listen.

Common FHA Loan Myths—Busted!

Let’s clear the air on some bullshit you might’ve heard.

- Myth #1: “FHA loans are only for first-time buyers.” Nope! Anyone who satisfies the conditions can apply, whether it’s your first rodeo or your fifth.

- Myth #2: “You can’t purchase a great property with an FHA loan.” Wrong again—those loan limits help you acquire a decent place, especially in high-cost cities.

- Myth #3: “The procedure is a nightmare.” It’s no worse than any other mortgage—just a few more processes, like the appraisal. My buddy Lisa imagined she’d be drowning in red tape, yet she closed in 45 days flat. Don’t let the rumors frighten you off.

Tips to Nail Your FHA Loan Application

Ready to make it happen? Here’s your playbook:

- Step one: get your credit report from all three bureaus (Equifax, Experian, TransUnion) and look for problems. An incorrect late payment might destroy your score—fix it soon.

- Step two: assemble your docs—two years of tax returns, current pay stubs, bank statements, and IDs. Being prepared shouts, “I’ve got my act together.”

- Step three: shop lenders like you’re searching for Black Friday discounts. Rates and fees vary, and a quarter-point difference might save you thousands.

- Step four: get pre-approved. It’s like a golden ticket—it informs you of your budget and indicates merchants you mean business.

- Last tip: hook up with a realtor who knows FHA loans—they’ll lead you toward properties that’ll pass muster.

FHA loan requirements nc: The Application Process

So, what’s it like applying? First, you’ll choose a lender and fill out an application—online or in person, your call. They’ll enquire about your financial life story—income, debts, the whole. Then follows the underwriting, where they double-check everything. This stage might take a few weeks, so don’t panic if it’s not instant.

Next, you’ll lock in your rate (pro tip: do this when rates plummet) and obtain that FHA evaluation. If the house passes and your paperwork checks out, you’re headed to closing. Sign a million pieces of paperwork, hand up your down payment, and boom—keys in hand. My first closure seemed like a marathon, but bursting that champagne after made it all worth it.

FHA Loan Requirements nc— Conclusion

There you go—the entire, unedited information on FHA loan requirements nc! From the lovely 3.5% down payment to the forgiving credit standards, these loans are like a high-five from the universe for anyone who’s been priced out of the housing game. Sure, you’ve got mortgage insurance and some property regulations to deal with, but the payoff? A place of your own without surrendering your soul—or your finances. Whether you’re a beginner buyer, bouncing back from a hard period, or just seeking a break, the FHA’s here to help. So, what’s next? Grab your papers, hit up a lender, and start chasing that dream house. You’re closer than you think—go grab it!