Hello, homebuyer—or perhaps you are simply thinking of eventually purchasing a house! In either case, you have most likely heard of credit union mortgage rates and questioned if they were worth the hoopla. There is a spoiler alert: they are! Like we are discussing over a cup of coffee, I am here to break it all down for you in an easily consumed manner. We are discussing what credit unions are, why their mortgage rates might be a game-changer, how they compare to large banks, and some insider advice to get the best deal. I also include real-world impressions from people who have been there and done that. Let’s start this 4000-word journey and see if credit union mortgage rates are your pass to homeownership!

Generally speaking, what is a credit union?

First off, let’s clear up what a credit union even is. Imagine this: a credit union is more like a financial co-op controlled by its members—you know, ordinary folks like you and me—than a massive, profit-hungry bank with stockholders to satisfy. They’re not here to make a buck; they’re here to help their members succeed. That’s the mood. When you join a credit union, you’re not simply a consumer; you’re part of the crew. You normally need to fulfil certain qualifying rules—like residing in a given location or working for a specified employer—but once you’re in, you’re golden.

Now, how does this fit into mortgage rates? Since credit unions don’t have to pad their earnings for Wall Street, they generally pass the savings on to you. That implies fewer fees, better interest rates, and often even more flexible terms on goods like mortgages. It’s not charity—it’s just how they roll. And in 2025, with the housing market doing its normal rollercoaster thing, those reduced mortgage rates might feel like a lifeline when you’re attempting to lock down a house loan without breaking the bank.

Why Credit Union Mortgage Rates Are a Big Deal

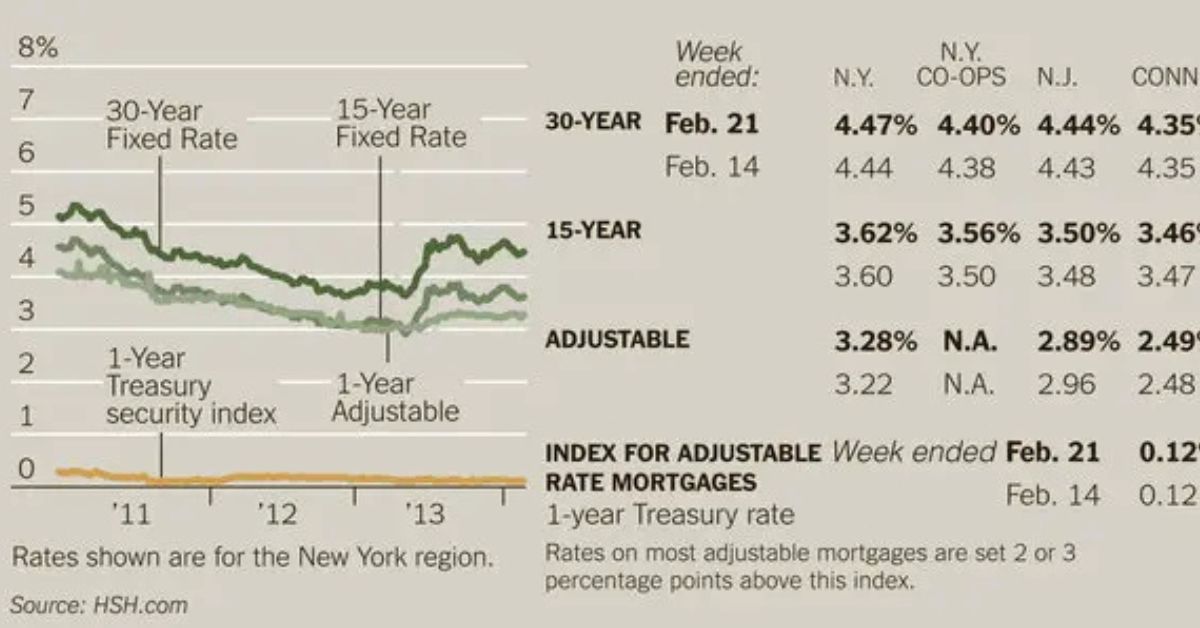

Alright, let’s get to the good stuff—why should you worry about credit union mortgage rates? For starters, they’re generally cheaper than what you’d find at a regular bank. Why? Because credit unions aren’t pursuing big profits. They take the money they earn—like interest on loans—and pour it back into improved bargains for members. In March 2025, for example, some credit unions are providing 30-year fixed-rate mortgages hanging around 6% or even diving lower, while major banks may be closer to 6.5% or more. Half a percent doesn’t sound like much, but on a $300,000 loan, that’s hundreds of bucks saved per year. Over 30 years? You’re talking significant dollars.

But it’s not just about the statistics. Credit unions like to keep things personal. You’re not simply another account number getting lost in a corporate jungle. Ever tried contacting a huge bank and spent 20 minutes on wait just to talk to someone who doesn’t care? Yeah, me too. At a credit union, you’re more likely to receive someone who truly knows your name and wants to assist. That personal touch may make a major impact when you’re handling something as substantial as a mortgage.

How Do Credit Union Mortgage Rates Work?

So, how do these rates come to life? It’s not magic, although it could seem like it when you see the savings. When you apply for a mortgage with a credit union, they’ll look at the usual suspects—your credit score, income, debt, and how much you’re putting down. Same as anywhere else. But here’s where it gets cool: because they’re member-focused, they could spare you some leeway if your credit’s a touch weak or if you’re a first-time buyer. They’re not as strict as those suits at the megabanks.

The rates themselves rely on a lot of factors—like what’s happening with the economy, the Federal Reserve’s recent decisions, and the credit union’s own policy. In early 2025, analysts are forecasting mortgage rates would decrease a bit—maybe averaging 5.9% for the year, according to some projections. Credit unions frequently ride the wave but chop off a bit extra. For instance, a 15-year fixed rate can clock in at 5.5% while a 30-year stands at 6%. You select the period that matches your budget—shorter durations mean larger payments but less interest overall, while longer terms spread it out but cost more in the long run. Either way, credit unions generally keep it competitive.

Comparing Credit Unions to Big Banks

Let’s put credit unions head-to-head with the big banks—think Chase, Wells Fargo, or Bank of America. On the surface, they’re both giving mortgages, right? But probe a bit deeper, and the disparities jump out like a sore thumb. Big banks have the wealth and the clout—tonnes of branches, slick applications, and marketing everywhere. But that comes at a cost. They’ve got stockholders to keep pleased; therefore, their mortgage rates tend to creep up higher, and fees? Don’t get me started. Origination fees, closing expenses, you name it—they pile on like toppings at a buffet.

Credit unions, on the other hand, keep it lean. No shareholders means no pressure to jack up rates. A buddy of mine acquired a mortgage through his local credit union last year—5.75% on a 30-year fixed with scarcely any costs. He investigated a large bank first, and they gave him 6.25% plus a $1,500 origination charge. Same credit score, same loan amount. That’s actual money remaining in his pocket. Plus, credit unions typically throw in advantages like free private mortgage insurance (PMI) if you’re close to 20% down or rate cuts if you set up autopay. Banks? They’re more likely to nickel and dime you.

The Pros of Credit Union Mortgage Rates

Alright, let’s build up the wins. Why go with a credit union for your mortgage? Here’s the rundown:

- Lower Rates: Like I stated, they’re frequently a bit below the big guys—sometimes by 0.25% to 0.5%. That accumulates up rapidly.

- Fewer Fees: No shareholder greed means they’re less likely to hit you with arbitrary charges. Closing expenses can be thousands less.

- Personal Service: You’re a member, not a number. Need to tweak your application? They’ll work with you.

- Flexibility: Bad credit? First-time buyer? Some credit unions offer particular initiatives to help you out.

- Community Vibes: Your money stays local, benefitting persons in your region instead of some CEO’s bonus.

I chatted to a gal on X who stated her credit union gave her a 5.9% rate while banks wouldn’t even look at her 620 credit score. She’s been paying it off for six months now, no remorse. That’s the type of win I’m talking about.

The Cons—Because Nothing’s Perfect

Okay, let’s keep things real—credit unions aren’t faultless. There are certain drawbacks you gotta weigh. For one, they’re not everywhere. Big banks have ATMs and branches on every corner; credit unions? Not so much. If you’re in a remote place or move a lot, that may be a headache. Some have shared branches or online banking to bridge the gap, but it’s not the same as strolling into a sparkling bank lobby.

Another thing? Options can be restricted. Banks have a bazillion loan types—FHA, VA, jumbo, you name it. Credit unions may stick to the basics—fixed rate, adjustable rate, maybe a first-time buyer discount. If you need something really specialist, like a construction loan, you could strike out. And certainly, their tech isn’t necessarily cutting-edge. My relative enjoys his credit union’s rates but gripes about their clumsy app. If you’re a digital junkie, that could bother you.

Real Talk: What People Are Saying in 2025

Let’s glance at the conversation. People are excited about credit union mortgage rates, especially now in March 2025. On X, one member remarked, “Just locked in 6% at my credit union—banks wanted 6.5%. Feels wonderful to keep stuff local.” Another stated, “Credit union got me a 15-year at 5.5%. Process was nice, no aggressive sales crap.” The vibe? Folks adore the discounts and the laid-back attitude, while a few grouse about delayed replies or limited loan quantities.

Online reviews echo that. Sites like NerdWallet and Trustpilot give credit unions accolades for cheap rates and member-first attitudes, but some caution about limited networks or stricter eligibility. One reviewer wrote, “Took longer to shut than I desired, but the rate was worth it.” It’s a trade-off—slower pace, sweeter deal. What’s your priority?

How to Snag the Best Credit Union Mortgage Rate

Ready to get in? Here’s how you obtain the best deal from a credit union. Trust me, a little prep goes a long way.

1. Boost Your Credit

Higher score, lower rate—it’s that easy. Pay off debt, address problems on your report, and don’t open new cards just before applying. Aim for 700+ if you can.

2. Shop Around

Not all credit unions are the same. One could offer 5.9%, another 6.2%. Check a few in your area—most let you examine sample prices online or with a short call.

3. Join Early

You need to be a member to acquire the loan. Sign up before you apply—usually simply a small payment, like $5, into a savings account. Easy breezy.

4. Ask About Discounts

Some credit unions decrease your rate if you autopay from their checking account or bundle additional services. Doesn’t hurt to ask!

5. Lock It In Rates swing around every day.

Once you locate a good one—say, 6% on a 30-year—lock it in so it doesn’t increase before you close.

My neighbor did this last month. Shopped three credit unions, locked in 5.85%, and saved $200 a month compared to his bank’s offer. Smart decisions pay handsomely.

Types of Mortgages You’ll Find at Credit Unions

Wondering what’s on the menu? Credit unions often provide the classics, plus a few tweaks. Here’s the lineup:Fixed-Rate Mortgages:

- Your rate stays put—say, 6% for 30 years. Payments don’t budge, perfect for planning.

- Adjustable-Rate Mortgages (ARMs): Starts lower—like 5%—but can move after a few years. Risky but cheaper upfront.

- First-Time Buyer Loans: Low down payments (often 3%) and flexible credit conditions. Perfect if you’re new to this.

- Jumbo Loans: For huge properties exceeding $806,500 (in most places). Rates can be 6.25% or such.

- VA or FHA Loans: Some credit unions join with these programs for vets or low-income buyers—super cheap rates, like 5.5%.

Not every credit union has all of these, so verify what’s up for grabs. My local one gives fixed-rate and first-time buyer deals, but no jumbos. Know what you need before you dig in.

Credit Union Mortgage Rates in 2025: What’s the Forecast?

What’s the crystal ball saying for 2025? Experts—like the ones at Fannie Mae—are thinking mortgage rates would stabilise around 5.9% on average. Credit unions might drop below that, maybe 5.7% or 5.8% for a 30-year fixed if trends persist. Why? The Fed’s been toying with interest rates, and with inflation falling off (fingers crossed), borrowing prices could loosen significantly. Credit unions, being agile, frequently pounce on these trends sooner than banks.

But it’s not fixed in stone. If the economy hiccups—say, a recession hits—rates might decrease more. Or if inflation soars, they may climb. The point is, 2025 looks optimistic for inexpensive loans, and credit unions are primed to excel. Keep an eye on local rates—your credit union’s website or a simple call will tell you what’s cooking.

Alternatives to Credit Unions: What Else Is Out There?

Maybe credit unions aren’t your thing—or there’s none nearby. No worry; you’ve got alternatives. Big banks are the obvious one—higher rates, certainly, but tonnes of loan options and sleek software. Peer-to-peer financing, like Prosper or LendingClub, links you with investors online—rates vary, but it’s fast. Online lenders like Rocket Mortgage guarantee speed and simplicity, frequently about 6% or 6.1% in 2025. Or, if you’re tight with relatives, a private loan might bypass interest altogether—just keep it drama-free with a signed arrangement.

Each has its taste. Banks for stability, internet for speed, and credit unions for savings. What’s your vibe?

Are Credit Union Mortgage Rates Safe?

Quick safety check: are credit unions legit? Yup, definitely. They’re guaranteed by the NCUA (much like the FDIC for banks), so your money’s protected up to $250,000. Mortgage-wise, they’re as solid as anyone else—same paperwork, same legal everything. The catch? You’re bound to the lender they connect you with, so vet them. Look up reviews, verify their site, and make sure they’re not unscrupulous. Most credit unions play it straight, but it’s your cash—double-check.

Who’s Credit Union Mortgage Rates For?

So, who’s the perfect fit? If you’re seeking a cheap rate and don’t mind joining a membership, credit unions are your jam. First-time purchasers, those with so-so credit, or anyone who hates fees—they’re all ideal prospects. Got great credit and enjoy fancy apps? Maybe a bank’s your speed. It’s about what you value—savings and service, or bells and frills.

Conclusion: Should You Go for Credit Union Mortgage Rates?

Here’s the bottom line: credit union mortgage rates are a wonderful deal if you want reasonable, no-nonsense home loans. Lower rates, fewer fees, and that intimate member-first feel—it’s hard to match. Sure, they’ve had peculiarities, like restricted locations or simpler electronics, but for tonnes of individuals, the rewards outweigh the negatives. In 2025, with rates maybe sliding below 6%, they’re worth a serious study. Do your study, compare a few, and see whether they meet your home-buying aspirations. What do you think—ready to give a credit union a go for your next mortgage?