Comparing Student Loans: If you’re reading this, chances are you’re staring down a mountain of student loan options and feeling a little lost. Don’t sweat it—I’ve got your back. Navigating the world of student loans can be a rollercoaster, but by the end of this guide, you’ll have a clear roadmap to compare your options and pick the one that fits your life best. We’re diving into federal loans, private loans, refinancing, and everything in between. So, grab a snack, get comfy, and let’s break it all down together!

Understanding Student Loans: The Basics You Need to Know

Let’s kick things off with the fundamentals. Student loans are like a financial lifeline—they’re money you borrow to cover college or graduate school costs, which you’ll repay later with some extra cash tacked on (that’s the interest). Why do they even exist? Well, tuition’s been climbing faster than a squirrel up a tree, and most of us don’t have a spare $50,000 lying around. Scholarships and grants are awesome, but they don’t always cut it. Enter student loans to save the day—or at least bridge the gap.

Here’s a quick vocabulary lesson:

- Principal: The chunk of money you actually borrow.

- Interest: The fee for borrowing, usually a percentage of the principal.

- Repayment: Paying it all back, typically after you graduate or leave school.

There are two big players in this game: federal student loans (backed by Uncle Sam) and private student loans (from banks or other lenders). Federal loans tend to have fixed interest rates and perks like flexible repayment, while private loans can be a mixed bag depending on the lender. Knowing this sets the stage for comparing them, so let’s dive deeper.

Federal Student Loans: Your Government-Backed Options

Federal loans are often the go-to for students, and for good reason—they come with some sweet perks. The U.S. Department of Education runs the show here, offering a few different flavors of loans. Let’s unpack them.

Types of Federal Loans

- Direct Subsidized Loans

These are the VIPs of federal loans, reserved for undergrads with financial need. The government covers the interest while you’re in school, during a six-month grace period after graduation, and during deferment (like if you hit a rough patch). It’s like getting a free pass on interest for a while—pretty clutch, right? - Direct Unsubsidized Loans

These are open to undergrads and grad students, no need to prove you’re broke. The catch? You’re on the hook for all the interest from day one. It starts piling up while you’re in school, but you can delay payments until later (though the interest keeps growing). - PLUS Loans

Made for grad students or parents of undergrads, these have higher interest rates and require a credit check. They’re handy for covering whatever federal aid doesn’t, but they’re not cheap.

Comparing Student Loans: Interest Rates and Eligibility

Federal loan rates are fixed—locked in for the life of the loan. For the 2023-2024 school year, undergrads pay 5.50% on Direct Subsidized and Unsubsidized Loans, grad students pay 7.05% on Unsubsidized Loans, and PLUS Loans clock in at 8.05%. Not too shabby compared to some private options, huh?

To snag these loans, you’ll need to fill out the FAFSA (Free Application for Federal Student Aid). It’s your golden ticket to federal aid, and you’ll redo it yearly to stay eligible.

Comparing Student Loans: Repayment Plans

Here’s where federal loans shine. They offer a buffet of repayment options:

- Standard Repayment: Fixed payments over 10 years.

- Graduated Repayment: Payments start low and increase over time.

- Income-Driven Repayment (IDR): Ties payments to your income—think 10-20% of your discretionary cash—with forgiveness after 20-25 years.

Plus, there are forgiveness programs like Public Service Loan Forgiveness (PSLF) if you work in certain fields. That’s a lot of flexibility, which is why federal loans are a fan favorite.

Private Student Loans: The Wild Card

Now, let’s switch gears to private loans. These come from banks, credit unions, or online lenders like Sallie Mae or SoFi. They’re a solid backup if federal loans don’t cover everything—or if you can score a killer deal.

Comparing Student Loans: How They Work

Unlike federal loans, private loans are all over the map. Interest rates can be fixed (steady Eddie) or variable (up and down like a yo-yo), depending on the lender. Rates range widely—think 4% to 15%—and hinge on your credit score. No credit history? You might need a cosigner (like Mom or Dad) to vouch for you.

Comparing Student Loans: Pros and Cons

Private loans can fill gaps federal aid misses, and if your credit’s stellar, you might snag a lower rate than federal options. But there’s a flip side: no fancy repayment plans or forgiveness programs. Some lenders offer deferment or forbearance if you’re strapped, but it’s not guaranteed.

Shopping Around

Here’s the deal: every lender’s different. One might hit you with origination fees, while another offers no penalties for paying early. You’ve got to compare rates, terms, and fine print. It’s like dating—don’t settle for the first one that winks at you.

Comparing Student Loans: Federal vs. Private Loans

Alright, time for the main event—comparing federal and private loans head-to-head. Let’s break it down by key factors.

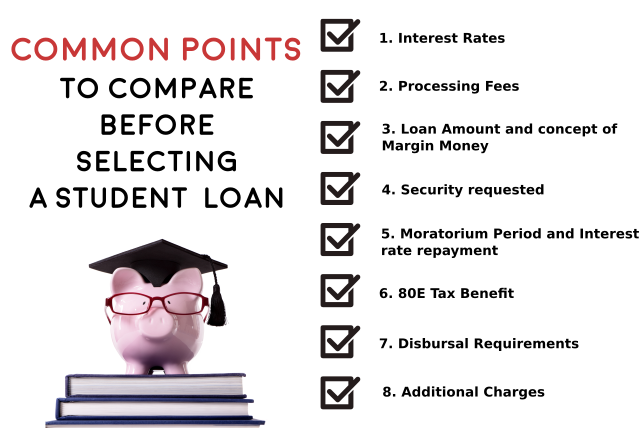

Interest Rates

- Federal: Fixed rates (5.50%-8.05% for 2023-2024). Predictable, no surprises.

- Private: Fixed or variable, anywhere from 4% to 15%. A great credit score could beat federal rates, but variables can spike.

Winner? Depends. Federal’s safer; private’s a gamble with potential rewards.

Repayment Flexibility

- Federal: Tons of options—standard, graduated, income-driven. Plus, deferment and forbearance are standard.

- Private: Slim pickings. Repayment terms vary (5-20 years), but no income-based plans or forgiveness.

Federal takes this round hands-down.

best private student loans with low interest rates

Borrower Protections

- Federal: Loan forgiveness (PSLF, IDR), discharge for death or disability, and economic hardship options.

- Private: Barely any. You’re at the lender’s mercy.

Federal wins again—big time.

Eligibility

- Federal: FAFSA-based, no credit check for most (except PLUS). Easy access.

- Private: Credit-driven. No credit? No dice—unless you’ve got a cosigner.

Federal’s more inclusive here.

Comparing Student Loans: Which Is Better?

It’s all about you. Federal loans are the safe bet—lower risk, more perks. But if you’ve got killer credit and don’t need forgiveness, a private loan with a low fixed rate might save you cash. Weigh your priorities: security or savings?

Refinancing Student Loans: A Game Changer?

Let’s talk refinancing—it’s like hitting the reset button on your loans. You take out a new private loan to pay off your old ones, aiming for a better rate or simpler terms.

- How long does it take to get a student loan?

- How to borrow money from Opay

- How can I borrow money from Opay

What’s the Deal?

Say you’ve got a mix of federal and private loans with high rates. Refinancing could drop your rate to, say, 4% and combine everything into one payment. Sounds tempting, right? It’s huge for private loan holders or grads with steady jobs and good credit.

The Catch

Here’s the kicker: refinance federal loans into a private one, and you lose those sweet government perks—forgiveness, IDR, all gone. It’s a big trade-off, so think hard.

When to Refinance

- Your credit’s improved since you borrowed.

- You’ve got high-interest private loans.

- You want one monthly payment instead of juggling multiple.

Shop around—lenders like Earnest or Laurel Road might offer better deals than your current setup. Use a calculator to see the total cost over time.

Tips for Choosing the Right Student Loan

Picking a loan isn’t rocket science, but it’s not a coin flip either. Here’s how to nail it:

- Start with Federal Loans

They’re usually the best deal—lower rates, more protections. Max these out first. - Compare Interest Rates

Fixed or variable? Low as possible? Check both federal and private offers. - Watch for Fees

Origination fees or prepayment penalties can sneak up. Avoid them if you can. - Test the Repayment Fit

Run the numbers—can you swing the monthly payment post-graduation? - Calculate Total Cost

A 5% rate over 10 years vs. 7% over 15? Use an online calculator to see the real price tag. - Read the Fine Print

Terms matter. Deferment options? Cosigner release? Know what you’re signing. - Borrow Smart

Only take what you need. More now = more pain later with interest.

Real-Life Scenarios: Putting It All Together

Let’s make this real with some examples.

Scenario 1: Sarah the Undergrad

Sarah’s a sophomore with financial need. She grabs a Direct Subsidized Loan at 5.50%—interest-free while in school. Post-grad, she lands a nonprofit gig and aims for PSLF. Federal’s her winner.

Scenario 2: Mike the Grad Student

Mike’s in med school, maxes out federal loans (7.05%), but needs more. His dad cosigns a private loan at 6% fixed. He plans to pay it off fast as a doctor—no forgiveness needed. Private works here.

Scenario 3: Jen the Refinancer

Jen’s got $50,000 in mixed loans at 8%. She refinances to 4.5% with a private lender, cutting her interest in half. She’s got a solid job and doesn’t need federal perks. Refinancing’s her move.

Common Mistakes to Dodge

Don’t trip over these:

- Ignoring Federal Loans: Skipping the FAFSA could cost you big.

- Falling for High Rates: Shop around—don’t take the first private offer.

- Overborrowing: That extra $10,000 might haunt you for decades.

- Missing the Fine Print: Skimming terms can bite you later.

FREQUENTLY ASKED QUESTIONS

Federal student loans are typically the best option for most borrowers because they offer benefits like lower fixed interest rates, income-driven repayment plans, and eligibility for loan forgiveness programs. These loans also don’t require a credit check or a cosigner, making them more accessible.

Plan 2 refers to a student loan taken out from September 2012 onwards, in England or Wales. Older loans (from England or Wales) and loans taken out in Northern Ireland, are called plan 1 loans. Loans taken out in Scotland are called plan 4 loans.

No. If you don’t pick a repayment plan, your loan servicer will place you on the Standard Repayment Plan. On the Standard Plan, you repay your loan(s) over 10 years. Your monthly payments on this plan are based on a 10-year schedule and not based on your income or your ability to pay.

Conclusion: Your Loan, Your Future

Phew, we’ve covered a lot! Comparing student loans might feel like herding cats at first, but it boils down to this: know your options, crunch the numbers, and pick what fits your vibe. Federal loans offer safety and flexibility—start there. Private loans can save you cash if you’ve got the credit to back it up. Refinancing? Perfect for streamlining high-rate debt, but watch those trade-offs. Borrow smart, plan ahead, and you’ll conquer that debt like a champ. Got questions? Hit me up—I’m here to help. Now go crush that education game!