Hey there! If you’re diving into the world of student loans, you’ve probably noticed how overwhelming it can feel. Tuition costs are climbing, scholarships don’t always cover everything, and federal loans might leave you short. That’s where private student loans step in—especially ones with low interest rates that won’t haunt you for decades. I’m here to walk you through everything you need to know about snagging the best private student loans with low interest rates that won’t break the bank. Buckle up—this is going to be a deep dive, but I’ll keep it fun, simple, and packed with info you can actually use!

What Are Private Student Loans?

Let’s start with the basics. Private student loans are funds you borrow from banks, credit unions, or online lenders—not the government—to pay for college or grad school. Unlike federal loans, which come from Uncle Sam with fixed rates and some sweet perks (like loan forgiveness), private loans are all about the lender’s rules. They’re a lifeline when federal aid doesn’t cut it, covering stuff like tuition, dorms, books, or even that study abroad trip you’ve been dreaming about.

But here’s the catch: private loans don’t have the same safety nets. No income-based repayment or forgiveness here. That’s why finding one with a low interest rate is clutch—it keeps your costs down and your stress levels manageable. So, how do you spot the good ones? Stick with me, and I’ll show you!

Why Best Private Student Loans with low interest rates Are a Big Deal

Picture this: you borrow $20,000 for school. With a 4% interest rate over 10 years, you’re paying about $5,250 extra in interest. Bump that rate to 6%, and it jumps to $7,973. That’s over $2,700 more for the same loan! Interest rates are like the secret sauce of borrowing—lower rates mean less money out of your pocket over time.

Private loans come with two flavors of rates: fixed and variable. Fixed rates stay steady, so your payments are predictable—like a reliable roommate who always pays rent on time. Variable rates can start lower but might spike later, depending on the market—kind of like a wild card. For most folks, fixed rates are the way to go, especially if you like knowing exactly what you’re in for. But if you’re feeling bold and think rates might drop, variable could save you a few bucks upfront. Your call!

What Makes Interest Rates Tick?

So, why do some people score awesome rates while others get stuck with higher ones? It’s not random—lenders have a checklist. Here’s what they’re eyeballing:

1. Your Credit Score (or Your Cosigner’s)

Your credit score is the VIP pass to low rates. It tells lenders how trusty you are with money. Got a score above 720? You’re golden—expect the best offers. Between 660 and 719? Still solid, but not top-tier. Below 600? You might need a cosigner—someone with stellar credit (like a parent) to vouch for you. Students often don’t have much credit history, so a cosigner can be a game-changer.

2. Cash Flow and Debt

Lenders peek at your income and how much debt you’re already juggling (your debt-to-income ratio). More income and less debt? Better rates. No job yet? A cosigner’s paycheck can seal the deal.

3. How Long You’ll Pay

Shorter loan terms—like 5 or 7 years—usually snag lower rates because lenders get their money back faster. Longer terms (15 or 20 years) might mean higher rates but lower monthly payments. It’s a trade-off—save now or stretch it out?

4. Fixed vs. Variable

Fixed rates are pricier upfront but lock in your cost. Variable rates tempt you with a low start but could climb later. Choose wisely based on your risk tolerance!

5. Lender Vibes

Every lender’s different. Some are stingy; others compete hard to win you over. That’s why shopping around is non-negotiable—you’ve got to find the one that’s hungry for your business.

How to Score the Lowest Rates Possible

Alright, you want those sweet, sweet low rates? Here’s your playbook:

1. Boost That Credit

Got a few months before applying? Pay off credit card balances, keep up with bills, and don’t open new accounts. Every little bit helps nudge your score up.

2. Team Up with a Cosigner

No credit? No problem. A cosigner with a killer score can unlock better rates. Just know they’re on the hook too—so pick someone you trust (and who trusts you!).

3. Go Short-Term

A shorter loan term means a lower rate and less interest overall. Your monthly bill might sting more, but you’ll be debt-free sooner.

4. Set It and Forget It with Autopay

Most lenders knock off 0.25% if you let them auto-deduct payments. It’s an easy win—saves cash and keeps you on track.

5. Shop ‘Til You Drop

Don’t grab the first offer. Hit up comparison sites or check multiple lenders directly. You can do this in a 30-day window without dinging your credit. More options, better odds!

ALSO READ…..

- How to earn free money on Cash App

- Best mortgage lenders in Alaska

- The Best Loan App in Nigeria 2022

- Loan app without bvn in Nigeria

- Student loans with low interest rates

The Best Private Student Loan Lenders with Low Rates

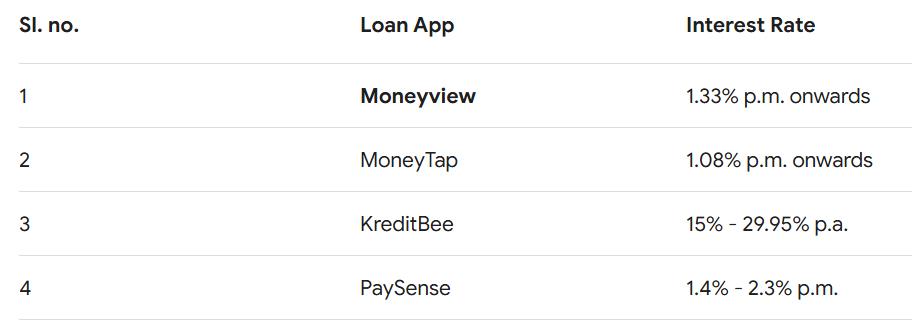

Now, the fun part—who’s got the goods? I’ve rounded up some top players offering low rates and solid perks. Rates shift, so double-check before you commit, but here’s the scoop as of early 2025:

1. SoFi: The Cool Kid on the Block

- Rates: Fixed starting at 3.54% APR, variable at 4.64% (with autopay).

- Why It Rocks: SoFi’s all about extras—career coaching, financial advice, even unemployment protection if life throws a curveball. No fees, flexible terms, and a slick app.

- Who’s It For: Students who want more than just a loan and don’t mind borrowing at least $5,000.

2. College Ave: The Flexible Friend

- Rates: Fixed from 4.24% APR, variable from 5.99% (with autopay).

- Why It Rocks: Pick your term (5 to 20 years) and when payments start. Super easy application, no hidden fees, and great customer service.

- Who’s It For: Anyone craving repayment options that fit their life.

3. Sallie Mae: The Classic Choice

- Rates: Fixed at 4.15% APR, variable at 5.37% (with autopay).

- Why It Rocks: Big name, big options—undergrad, grad, even trade school loans. Cosigner release after 12 on-time payments is a nice touch.

- Who’s It For: Students who might need a cosigner but want freedom later.

4. Ascent: The Creative One

- Rates: Fixed from 3.76% APR, variable from 5.29% (with autopay).

- Why It Rocks: Cool repayment plans—like starting small and ramping up as you earn more. International students with cosigners are welcome too.

- Who’s It For: Folks who want a loan that grows with them.

5. Earnest: The DIY Lender

- Rates: Fixed at 4.29% APR, variable at 5.62% (with autopay).

- Why It Rocks: Customize your term and payment amount. Skip a payment once a year if you’re in a pinch. No fees, all chill.

- Who’s It For: Control freaks who want a loan their way.

Quick Comparison Chart

Here’s a side-by-side look to keep things simple:

| Lender | Fixed Rate (APR) | Variable Rate (APR) | Repayment Terms | Cosigner Release? |

| SoFi | 3.54% | 4.64% | 5, 7, 10, 15 years | No |

| College Ave | 4.24% | 5.99% | 5-20 years | Yes |

| Sallie Mae | 4.15% | 5.37% | 5-15 years | Yes |

| Ascent | 3.76% | 5.29% | 5-20 years | Yes |

| Earnest | 4.29% | 5.62% | You pick! | Yes |

Rates include autopay discounts and are current as of March 2025.

The Good, the Bad, and the Ugly of Private Loans

Before you sign on the dotted line, let’s weigh the pros and cons:

Pros:

- Big Bucks: Borrow up to your full school costs—no cap like federal loans.

- Low Rates (Sometimes): With great credit, you might beat federal rates.

- Mix-and-Match Payments: Interest-only, deferred, or full payments while in school—your choice.

Cons:

- No Safety Net: Miss a payment? No federal forgiveness or deferment here.

- Credit Rules: Weak score? You’re stuck with high rates or a cosigner.

- Variable Risk: Those low starter rates could skyrocket.

A Real Story: How Jake Nailed a Low-Rate Loan

Let me tell you about Jake, a sophomore engineering major. He needed $10,000 after federal loans tapped out. His credit was meh (650), so he roped in his mom as a cosigner (score: 780). After some digging, Jake picked SoFi’s 3.8% fixed rate over 10 years. His monthly payment? About $132. Total interest? Around $3,840.

If he’d gone with a 5.8% rate instead, he’d have paid $5,960 in interest—over $2,000 more! Jake’s smart move—comparing lenders and using a cosigner—kept cash in his pocket for textbooks (and maybe a few pizzas).

How to Apply Without Losing Your Mind

Ready to jump in? Here’s the step-by-step:

- Check Your Credit: Pull your report (free at AnnualCreditReport.com) and fix any boo-boos.

- Round Up Docs: ID, school enrollment proof, income info—plus the same from your cosigner if you’ve got one.

- Apply Online: Takes 10 minutes. You’ll hear back fast—sometimes instantly.

- Read the Fine Print: Rates, terms, fees—know what you’re signing up for.

- Seal the Deal: Accept the offer, finish school paperwork, and watch the funds roll in.

Pro tip: Apply to a few lenders at once (within 30 days) to compare offers without tanking your credit. Easy peasy!

FREQUENTLY ASKED QUESTIONS

for most students, federal student loans are generally the best option due to their lower interest rates, flexible repayment options, and forgiveness programs. However, private student loans may be necessary for some students who have exhausted federal loan options or need additional funds.

Start with federal student loans.

Federal student loans don’t have credit requirements, and they come with income-driven repayment plans and forgiveness programs.

Other Ways to Pay for School

Not sold on private loans? Try these first:

- Scholarships: Free money—hunt ‘em down on sites like Fastweb.

- Work-Study: Earn cash on campus while you learn.

- Payment Plans: Spread tuition over months, no interest.

- Parent PLUS Loans: Fixed rates, federal perks—parents can borrow for you.

Wrapping It Up: Your Path to a Great Private Loan

Alright, we’ve covered a lot! Private student loans can be your ticket to finishing school, but low interest rates are the key to keeping them affordable. Shop around, tweak your credit, grab a cosigner if you need one, and pick a lender that fits your vibe. SoFi, College Ave, Sallie Mae, Ascent, Earnest—they’re all solid bets with rates that won’t make you cry.

Don’t rush—max out federal aid and free money first. But if private loans are your move, you’ve got the tools to score a deal that won’t weigh you down. So, what’s next? Start comparing rates today and take charge of your college cash flow. You’ve got this!