If you’re a veteran, active-duty service member, or maybe even a surviving spouse dreaming of owning a home, you’ve probably heard about VA home loans. They’re a fantastic perk, designed to make homeownership easier and more affordable for those who’ve served. But before you start picturing yourself sipping coffee on your new porch, there’s a key step you can’t skip: getting pre-approved for a VA home loan. Trust me, it’s not as intimidating as it sounds, and it’s your ticket to a smoother, smarter home-buying journey. In this guide, I’m going to walk you through everything you need to know about VA home loan pre approval—what it is, why it matters, and how to get it done. Ready? Let’s dive in!

What’s a VA Home Loan, Anyway?

First things first, let’s get the basics down. A VA home loan is a mortgage option backed by the U.S. Department of Veterans Affairs, created specifically for folks like you—veterans, active-duty service members, National Guard or Reserve members, and certain surviving spouses. It’s a thank-you from Uncle Sam for your service, and it comes with some pretty sweet perks. No down payment? Check. Lower interest rates than most conventional loans? Yup. No private mortgage insurance (PMI) eating into your monthly budget? You bet.

The idea is simple: the VA guarantees a portion of the loan, which means lenders are more willing to offer you favorable terms. It’s not a loan directly from the VA—they don’t hand you the cash—but rather a program that works through private lenders like banks or mortgage companies. And here’s the kicker: before you can start house hunting with confidence, you need to get pre-approved. Think of it like getting the green light to start your mission. So, what’s this pre-approval thing all about? Let’s break it down.

Pre Approval vs. Pre Qualification: What’s the Difference?

These terms might sound similar, and it’s easy to mix them up. But they’re not the same, and understanding the difference is huge. Picture this: pre qualification is like a quick chat with a lender. You tell them your income, debts, and maybe a rough idea of your credit score, and they give you a ballpark figure of what you might borrow. It’s casual, fast, and doesn’t require much paperwork. Helpful? Sure. Reliable? Not really.

Pre approval, though, is the real deal. It’s like rolling up your sleeves and letting the lender dig into your financial life. They’ll check your credit, verify your income, look at your bank statements—the works. At the end, you get a solid number of how much they’re willing to lend you, plus a pre-approval letter you can wave around when you’re ready to make an offer. For a VA loan, it also means confirming your eligibility with something called a Certificate of Eligibility (COE). Basically, pre-approval says, “Hey, I’m serious about buying a home, and I’ve got the finances to back it up.” Sellers love that, and you will too.

Why Bother with VA Home Loan Pre Approval?

Okay, so why not just skip this step and start touring houses? Well, you could, but here’s why pre approval is worth your time:

- You’ll Know Your Budget: No more guessing games. Pre approval tells you exactly how much you can borrow, so you’re not drooling over a mansion when your budget says cozy bungalow.

- You Look Like a Rockstar to Sellers: In a hot market, sellers want buyers who are ready to roll. That pre approval letter? It’s proof you’re not just window shopping—it makes your offer stand out.

- Faster Closing: Since the lender’s already done a lot of the legwork, final approval moves quicker once you find “the one.” Less waiting, more moving in.

- No Nasty Surprises: Ever found out your credit’s a mess right when you’re about to sign? Pre-approval catches those hiccups early, giving you time to fix them.

Imagine you’re a veteran fresh off a PCS (Permanent Change of Station), ready to settle down. You spot a cute house with a big backyard—perfect for the kids and the dog. But without pre approval, you’re just another hopeful buyer. With it? You’re the one the seller calls back. It’s a no-brainer, right?

How to Get VA Home Loan Pre Approval: Step-by-Step

Alright, let’s get practical. Getting pre approved isn’t rocket science, but it does take a little prep. Here’s your game plan, broken down into five easy steps.

Step 1: Check Your Eligibility

Before anything else, make sure you qualify for a VA loan. Most veterans with at least 90 days of active duty during wartime or 181 days during peacetime are in. Active-duty folks, National Guard, and Reserve members with six years of service usually qualify too. Surviving spouses? You might be eligible if your partner died in service or from a service-related issue—just check with the VA.

You’ll need your Certificate of Eligibility (COE) to prove it. You can grab this online through the VA’s eBenefits portal, mail in a VA Form 26-1880, or let your lender snag it for you. It’s a quick step, but it’s non-negotiable.

Step 2: Pick the Right Lender

Not every lender knows VA loans inside and out, so shop smart. Look for a VA-approved lender with experience helping folks like you. Ask around—maybe your buddy from basic training has a recommendation—or check online reviews. Some big banks do VA loans, but smaller mortgage companies can be goldmines too. The VA’s website even has a lender search tool if you’re stuck. Point is, find someone who gets it and won’t leave you hanging.

Step 3: Round Up Your Paperwork

Lenders need to see the numbers behind your story. Here’s what to gather:

- Proof of Service: Your COE or DD-214 if you’re a veteran.

- Income Docs: Last 30 days of pay stubs, two years of W-2s, or tax returns if you’re self-employed.

- Bank Statements: Two months’ worth, showing savings or investments.

- ID: Driver’s license or passport—something official.

- Debt Details: List your car loans, student loans, credit cards—anything you owe.

Got a deployment coming up? Double-check your income docs reflect your current pay, including any hazard pay or allowances. Scan everything into PDFs—you’ll thank yourself later.

Step 4: Apply Like a Pro

Time to make it official. Most lenders let you apply online or over the phone—just fill out their form with your income, job history, debts, and assets. Be upfront about everything; they’ll verify it anyway. Once you hit submit, the waiting game begins. Pro tip: apply with one lender at a time—multiple hard credit pulls can ding your score.

Step 5: Get Your Pre-Approval Letter

The lender crunches the numbers, and if all’s good, they’ll send you a pre-approval letter with your loan amount. It might take a few days, maybe a week if they’re swamped. That letter’s your golden ticket—keep it handy for when you’re ready to house hunt.

What Documents Do You Really Need for a VA Home Loan Pre approval?

Let’s zoom in on that paperwork because it’s the backbone of pre approval. Here’s the rundown, with a little extra detail to keep you ahead of the curve:

- Certificate of Eligibility (COE): This little gem proves you’re VA-loan-ready. No COE, no dice. If you’re struggling to get it, your lender can usually pull it through their system.

- Pay Stubs: Last 30 days, showing your regular income. If you’re on active duty, include your LES (Leave and Earnings Statement).

- W-2s or Tax Returns: Two years ago. Self-employed? You’ll need tax returns plus a profit/loss statement to show you’re legit.

- Bank Statements: Two months, all pages—even the blank ones. Lenders want to see your cash flow and savings.

- Credit Report: They’ll pull it, but peek at yours first (try AnnualCreditReport.com). Fix any errors before they see it.

- Debt Info: Jot down balances and payments for all your debts. Did you get a car loan from that sweet ride you bought post-deployment? Include it.

Here’s a hack: organize everything in a folder—digital or physical—so you’re not scrambling when the lender calls. It’s like prepping for an inspection; neatness counts.

- Fast loan advance reviews

- Grace loan advance reviews

- Fha loan requirements nc

- Ladder Loans Reviews

- 5K Funds Reviews

The Perks of VA Loan Pre Approval: Why It’s a Game-Changer

Still on the fence? Let’s talk benefits—because this isn’t just busywork. Pre-approval sets you up to win in ways you might not expect.

For starters, it’s a reality check. You might think you can swing a $400,000 house, but if the lender says $300,000, you adjust before your heart’s set on something out of reach. It’s like knowing your ammo count before a mission—plan accordingly.

Then there’s the seller angle. Picture two offers: one from you, pre-approved and ready, and one from some guy who “thinks” he can get a loan. Who’s the seller picking? You, every time. That letter’s your edge in a bidding war.

And don’t sleep on the speed factor. Pre-approval knocks out half the paperwork upfront, so when you find your dream home, you’re not twiddling your thumbs waiting for approval. You’re signing papers while the other guy’s still digging up pay stubs.

Oh, and one more thing: peace of mind. Knowing your credit’s solid and your finances check out? That’s a weight off your shoulders. No last-minute panics about a rejected loan—just smooth sailing to closing day.

Common Mistakes to Dodge

Even the best of us can trip up, so let’s cover some pitfalls to avoid. These are rookie moves you don’t want to make:

- Skipping the Credit Check: Don’t assume your credit’s fine—check it first. A low score or old debt could tank your pre-approval. Fix it early.

- Applying Everywhere: Shopping rates are smart, but full applications with multiple lenders? That’s too many credit hits. Compare soft quotes first, then pick one.

- Fudging the Truth: Tempted to “forget” that credit card balance? Don’t. Lenders will find it, and it’ll hurt more later.

- Ignoring the Funding Fee: VA loans have a fee—usually 1.25% to 3.3% of the loan. You can roll it into the mortgage, but factor it in so you’re not blindsided.

- Maxing Out the Loan: Just because you’re approved for $350,000 doesn’t mean you should spend it all. Leave room for taxes, insurance, and that new grill you’ve been eyeing.

Steer clear of these, and you’re golden. It’s all about setting yourself up for success, not stress.

How Long Does It Take to get VA Home Loan Pre approval?

Wondering about the timeline? Good question. Pre-approval isn’t instant, but it’s not a marathon either. If you’ve got your docs lined up, it might take 3-5 business days. Busier lenders or tricky finances—like self-employment or a past bankruptcy—could stretch it to a week or two. The VA part (getting your COE) is usually quick if you go through eBenefits—sometimes same-day, sometimes a few days by mail.

Point is, don’t wait until you’re standing in front of your dream house to start. Get pre-approved now, and you’re ready when the right place pops up.

VA Home Loan Pre Approval FAQs: Quick Answers to Big Questions

There’s no hard cap from the VA anymore (as of 2020, loan limits are gone for full entitlement), but your lender sets the amount based on your income, debts, and credit. Pre-approval locks in your personal number.

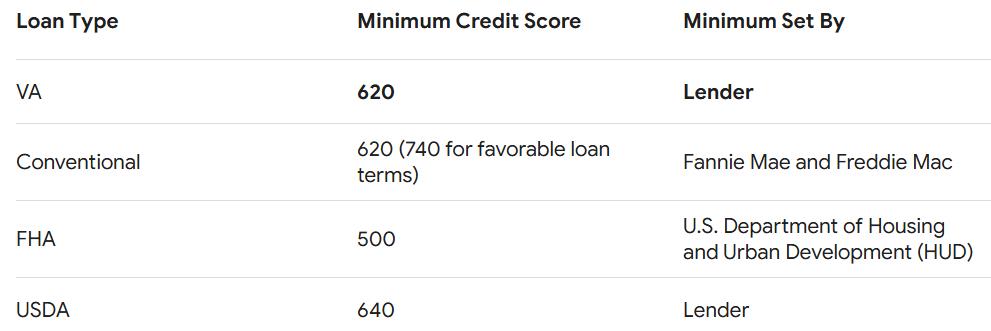

Nope! The VA doesn’t set a minimum, but most lenders want 620 or higher. Some go as low as 580 if your finances are solid elsewhere. Check yours to be sure.

Typically 60-90 days. If you don’t find a house by then, the lender might need updated docs to refresh it. No biggie—just plan your hunt accordingly.

Tips to Make Pre-Approval a Breeze

Want to nail this? Here are some insider tricks:

- Boost Your Credit: Pay down small debts or fix errors before applying. Every point helps.

- Save Extra Cash: Lenders like seeing reserves—money left after closing. It’s not required, but it strengthens your case.

- Talk to a Vet: Chat with a fellow service member who’s done it. Their real-world tips beat any blog post (except maybe this one!).

- Ask Questions: Confused about the funding fee or debt ratios? Grill your lender—they’re there to help.

Little moves like these turn a good application into a great one.

A Quick Comparison: VA Loans vs. Conventional Loans

Still curious how VA loans stack up? Here’s a snapshot:

| Feature | VA Loan | Conventional Loan |

| Down Payment | 0% (usually) | 3-20% |

| Interest Rates | Lower | Higher |

| PMI | None | Required if <20% down |

| Credit Minimum | Flexible (lender sets) | Often 620+ |

| Funding Fee | Yes (1.25%-3.3%) | No |

See why VA loans are a steal? Pre-approval gets you in the game to snag these benefits.

Wrapping It Up: Your Next Step to Homeownership

So, there you have it—your roadmap to VA home loan pre-approval. It’s not just a hoop to jump through; it’s your launchpad to owning a home on your terms. You’ll know your budget, impress sellers, and dodge surprises, all while cashing in on a benefit you’ve earned. Whether you’re a vet settling down after years of moving or a spouse honoring a loved one’s legacy, this is your shot at planting roots.

Take a breath, grab your COE, and reach out to a VA-approved lender today. That dream home’s waiting, and pre-approval is the key to unlocking the door. You’ve got this!