Hey there! Picture this: It’s 2022 in Nigeria, and life throws you a curveball. Maybe your fridge just gave up, or you’ve got a sudden school fee deadline staring you down. You don’t have the cash on hand, and trudging to a bank for a loan feels like a marathon you don’t have time to run. What’s the move? Loan apps, my friend! These little digital helpers exploded in popularity in Nigeria in 2022, offering fast, fuss-free cash right from your phone. But with so many options, how do you pick the best loan app in Nigeria 2022? Don’t worry—I’ve got you covered. In this article, we’ll dive deep into the top loan apps, what makes them great, and how to choose the one that fits your needs. Let’s get started!

Why Loan Apps Took Over Nigeria in 2022

First things first, why were loan apps such a big deal in 2022? Well, Nigeria’s economy wasn’t exactly handing out favors that year. Inflation was climbing, fuel prices were a rollercoaster, and the naira wasn’t feeling too strong. For everyday folks—students, small business owners, or even salaried workers—getting quick cash became a survival skill. Traditional banks? They’re like that friend who promises to help but takes forever to show up. You’d need stacks of paperwork, a guarantor or two, and maybe even a spare kidney to qualify for a loan. Meanwhile, loan apps swooped in with a promise: money in minutes, no drama.

By 2022, over 200 loan apps had gotten the green light from Nigeria’s Federal Competition and Consumer Protection Commission (FCCPC). That’s a lot of choices! They thrived because they offered what banks couldn’t: speed, simplicity, and accessibility. Whether you were in Lagos hustling or chilling in Kano, all you needed was a smartphone and a few taps to get funds. But here’s the catch—not every app was a winner. Some had crazy interest rates, others had shady vibes. So, how do you separate the champs from the chumps? Let’s break it down.

What Makes a Loan App the “Best”?

Before we jump into the top apps, let’s talk about what makes a loan app worth your time. Think of it like picking a restaurant—you want good food, fast service, and a price that doesn’t make you cry. Here’s what to look for in a loan app:

1. Ease of Use

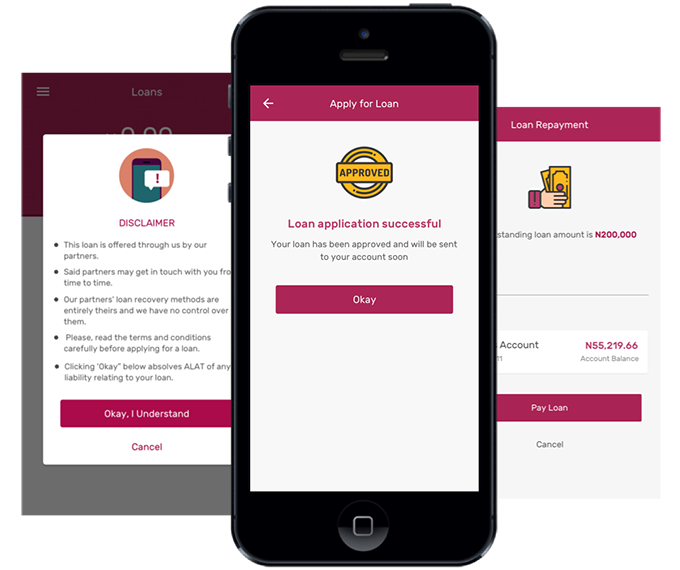

You don’t want an app that feels like a puzzle designed by a mad scientist. The best ones are simple—clean layouts, clear steps, and no tech headaches. You should be able to apply for a loan, check your status, and pay it back without needing a manual.

2. Speedy Approval

When you’re in a pinch, waiting days for approval isn’t an option. Top apps approve loans in minutes—sometimes even faster than you can boil yam. Look for ones that deliver cash to your accountpromptly

3. Fair Interest Rates

Here’s the deal: loan apps aren’t cheap. They’re convenient, but that convenience comes with a price—higher interest rates than banks. Still, the best ones keep it reasonable and upfront. No hidden fees to ambush you later.

4. Trust and Safety

You’re handing over personal info—your name, BVN, bank details. The last thing you need is an app that’s sketchy with your data. Go for apps licensed by the Central Bank of Nigeria (CBN) or FCCPC. Bonus points if they’ve got solid user reviews.

5. Customer Support

Ever had a problem and couldn’t reach anyone? Frustrating, right? The best apps have your back with quick, friendly support—think phone lines, chat, or email that actually works.

6. Extra Goodies

Some apps don’t stop at loans. They throw in cool extras like bill payments, savings options, or even investment tools. It’s like getting a combo meal instead of just fries.

Got that? Awesome. Now, let’s meet the rockstars of the loan app world in Nigeria for 2022.

The Best Loan App in Nigeria 2022

I’ve dug through the noise and picked out the best loan apps that ruled Nigeria in 2022. These are the ones people love, based on their features, ratings, and real-world usefulness. Let’s check them out!

1.Carbon: The All-Rounder

Carbon is one of The Best Loan App in Nigeria 2022, once called Paylater, was a heavy hitter in 2022. It’s like the Swiss Army knife of loan apps—loans, bill payments, investments, you name it. You could borrow anywhere from ₦2,500 to ₦1,000,000, with repayment stretching from 61 days to a full year. Interest rates? They range from 4.5% to 30% monthly, depending on your credit vibe.

- Loan Range: ₦2,500 – ₦1,000,000

- Interest: 4.5% – 30% monthly

- Repayment: 61 days – 12 months

- Why It Rocks: Fast loans, extra services, CBN-licensed

- User Buzz: 4.4 stars (130,000+ reviews)

Carbon’s big win is its reliability. It’s insured by the Nigeria Deposit Insurance Corporation (NDIC), so your money’s safe. Need cash quickly and want to pay your DSTV bill? Carbon’s your guy.

2.Branch: The Speed King

Branch was all about speed in 2022. Need money yesterday? This app could hook you up with ₦1,000₦1,000 to ₦1,000,000, approved in minutes. Repayment runs from 62 days to a year, and interest sits between 3% and 23% monthly. Plus, you can save money in the app and earn a little interest—sweet, right?

- Loan Range: ₦1,000 – ₦1,000,000

- Interest: 3% – 23% monthly

- Repayment: 62 days – 1 year

- Why It Rocks: Lightning-fast approval, savings feature

- User Buzz: 4.5 stars (813,000+ reviews)

Branch is perfect if you’re always on the go and need cash without the wait. It’s got a massive fanbase for a reason.

3. FairMoney: The Digital Bank Buddy

FairMoney wasn’t just a loan app, it was also one of The Best Loan App in Nigeria 2022—it was a mini bank in your pocket. Loans went from ₦1,500 to ₦1,000,000, with repayment terms from 61 days to 18 months. Interest rates? Between 2.5% and 30% monthly. It even offered SME loans and a debit card. Over 10 million Nigerians downloaded it, so you know it’s legit.

- Loan Range: ₦1,500 – ₦1,000,000

- Interest: 2.5% – 30% monthly

- Repayment: 61 days – 18 months

- Why It Rocks: Banking features, SME support

- User Buzz: 4.4 stars (478,000+ reviews)

FairMoney’s a champ for anyone wanting more than just a loan—think business owners or folks who love a one-stop financial shop.

4. Palmcredit: The Quick Fix

Palmcredit kept it simple in 2022. It’s like a virtual credit card for smaller loans—₦2,000 to ₦100,000. Repayment is short, from 14 to 180 days, with interest between 14% and 24%. It’s super easy to use and dishes out cash fast.

- Loan Range: ₦2,000 – ₦100,000

- Interest: 14% – 24%

- Repayment: 14 – 180 days

- Why It Rocks: Simple, fast, referral bonuses

- User Buzz: 4.2 stars (174,000+ reviews)

Need a small boost to tide you over? palmCredit’s your go-to.

5. Aella: The Worker’s Friend

Aella stood out in 2022 for salaried folks. Loans went up to ₦1,000,000, with repayment from 1 to 3 months and interest from 6% to 20% monthly. It also offered insurance and investment options—pretty cool, huh?

- Loan Range: Up to ₦1,000,000

- Interest: 6% – 20% monthly

- Repayment: 1 – 3 months

- Why It Rocks: Employee-focused, extra services

- User Buzz: 4.4 stars (35,700+ reviews)

Aella’s a solid pick if you’ve got a steady job and want a reliable loan partner.

6. OKash: The Long-Term Option

OKash, run by Blue Ridge Microfinance Bank, gave you loans from ₦3,000 to ₦500,000 and became one of The Best Loan App in Nigeria 2022. Repayment stretched from 91 to 365 days, but watch out—interest rates were steep, with an APR of 36.5% to 360%. It’s all about quick approval with minimal hassle.

- Loan Range: ₦3,000 – ₦500,000

- Interest: 36.5% – 360% APR

- Repayment: 91 – 365 days

- Why It Rocks: Long repayment, fast cash

- User Buzz: 4.3 stars (198,000+ reviews)

OKash works if you need more time to pay back, but those rates mean you’ve got to plan carefully.

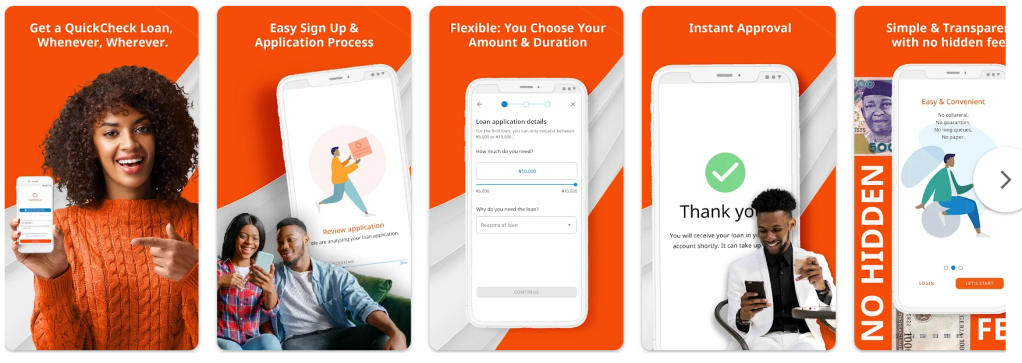

7. QuickCheck: The Tech Whiz

QuickCheck used some fancy AI magic in 2022 to figure out if you’re good for a loan. You could grab ₦1,500 to ₦500,000, with interest starting at 5% for the first month. Repayment’s tight—15 to 30 days.

- Loan Range: ₦1,500 – ₦500,000

- Interest: Starts at 5%

- Repayment: 15 – 30 days

- Why It Rocks: Smart tech, quick funds

- User Buzz: 4.1 stars (65,763+ reviews)

QuickCheck’s great for short-term needs and tech lovers.

8. Renmoney: The Big Spender

Renmoney was the big daddy of loans and also one of The Best Loan App in Nigeria 2022, offering up to ₦6,000,000. Repayment could go as long as 24 months, and interest varies. It’s a microfinance bank, so it’s got that official feel.

- Loan Range: ₦50,000 – ₦6,000,000

- Interest: Varies

- Repayment: Up to 24 months

- Why It Rocks: Huge loans, business-friendly

- User Buzz: 4.1 stars (32,846+ reviews)

Renmoney’s your pick for major expenses or business moves.

9. Sycamore: The Privacy Pro

Sycamore kept things tight in 2022 with loans, investments, and bill payments. It’s NDPR-certified, meaning your data’s safe. Loan amounts and rates vary, but it’s all about flexibility.

- Loan Range: Varies

- Interest: Competitive

- Repayment: Flexible

- Why It Rocks: Data security, multi-features

- User Buzz: 4.0 stars (32,846+ reviews)

Sycamore’s ideal if you’re big on privacy and want extras.

10. Kuda Bank: The Banking Bonus

Kuda Bank mixed loans with digital banking in 2022. You could get up to ₦100,000 as an overdraft or short-term loan, with repayment up to 3 months. Rates vary, but the app’s slick.

- Loan Range: Up to ₦100,000

- Interest: Varies

- Repayment: Up to 3 months

- Why It Rocks: Banking + loans, user-friendly

- User Buzz: 4.4 stars (32,650+ reviews)

Kuda’s perfect if you want loans and banking in one neat package.

How Do They Stack Up?

Still torn? Here’s a quick comparison table to see how these apps line up:

| App | Loan Amount | Interest Rate | Repayment | Standout Feature |

| Carbon | ₦2,500 – ₦1M | 4.5% – 30% monthly | 61 days – 1 year | All-in-one financial tools |

| Branch | ₦1,000 – ₦1M | 3% – 23% monthly | 62 days – 1 year | Super-fast approval |

| FairMoney | ₦1,500 – ₦1M | 2.5% – 30% monthly | 61 days – 18 months | Digital banking + SME loans |

| Palmcredit | ₦2,000 – ₦100K | 14% – 24% | 14 – 180 days | Simple and quick |

| Aella | Up to ₦1M | 6% – 20% monthly | 1 – 3 months | Great for employees |

| OKash | ₦3,000 – ₦500K | 36.5% – 360% APR | 91 – 365 days | Long repayment terms |

| QuickCheck | ₦1,500 – ₦500K | Starts at 5% | 15 – 30 days | AI-powered lending |

| Renmoney | ₦50K – ₦6M | Varies | Up to 24 months | Big loans for big needs |

| Sycamore | Varies | Competitive | Flexible | Data privacy focus |

| Kuda Bank | Up to ₦100K | Varies | Up to 3 months | Banking integration |

See what fits? If you need a tiny loan fast, Palmcredit’s your pal. Big project? Renmoney’s got the muscle.

Real Stories: How These Apps Saved the Day

Let’s bring this to life with some everyday examples (imagine these are your neighbors!).

Ada’s Inventory Boost

Ada owns a small clothing shop in Lagos. In December 2022, she needed ₦200,000 to stock up for the holidays. Banks were too slow, so she tried Carbon. Ten minutes after applying, she got approved, and the cash hit her account that day. Her shop stayed stocked, and she made a killing during the festive rush.

John’s Medical Emergency

John’s a student in Abuja who got hit with a ₦50,000 medical bill out of nowhere. No savings, no time to waste. He downloaded Branch, applied, and had the money in hours. He paid it back over three months—stress-free.

These stories show how loan apps were game-changers in 2022.

FAQ: Your Burning Questions Answered

Got questions? I’ve got answers!

FairMoney Microfinance Bank is the number 1 most downloaded fintech app in Nigeria. With over 10,000 daily loan disbursements, and over 5 million users enjoying banking, savings, and investment services, FairMoney helps the average Nigerian access finance tools to take control of both their life and their finances.

Zype is here to help! Whether it’s for a medical expense, utility bill, or unexpected shopping, Zype makes getting a ₹5000 emergency loan quick and stress-free. Get instant approval in just 6 minutes and receive funds in your account within 60 seconds.

Yes, OPay offers loan services, including short-term and long-term loans, through its “Okash” or “Loans” feature, accessible within the OPay app after verifying your identity and linking your BVN.

How Do I Apply?

Download the app, sign up with your details (name, phone, BVN), and fill out a quick form. If approved, the money’s sent to your bank account—easy peasy.

Who Can Get a Loan?

You need to be Nigerian, 18+, with a valid ID and bank account. Some apps might ask about your job or income, but it’s usually light.

Bad Credit? No Problem?

Apps like FairMoney and Carbon look at more than just credit scores. You might still get a loan, though the interest could sting a bit.

What If I Can’t Pay Back on Time?

Late payments mean extra fees and a hit to your credit. Most apps offer help if you reach out—don’t ghost them!

Are These Apps Safe?

Stick to CBN or FCCPC-approved ones, and you’re golden. Check reviews and privacy policies to be sure.

Conclusion: Your Perfect Loan App Awaits

So, there you have it—the best loan apps in Nigeria for 2022, laid out like a buffet. Whether it’s Carbon’s versatility, Branch’s speed, or Renmoney’s big bucks, there’s something for everyone. In a year when money was tight and time was tighter, these apps stepped up, giving Nigerians a lifeline when they needed it most. Pick one based on what you need—speed, size, or extras—and borrow smart. Only take what you can pay back, and you’ll be just fine. Got a favorite? Let me know—I’m all ears!