Introduction

If you’ve ever found yourself in a financial crisis, you’ve definitely Googled something like “fast loans near me” or “quick cash online.” Life throws curveballs—car repairs, medical expenses, or that odd expenditure you didn’t see coming—and sometimes you need money, like, yesterday. That’s when services like Fast Loan Advance come into play. But are they legit? Are they worth your time? Let’s delve into all you need to know about Fast Loan Advance reviews, how it works, and whether it’s the ideal match for you.

What Is Fast Loan Advance, Anyway?

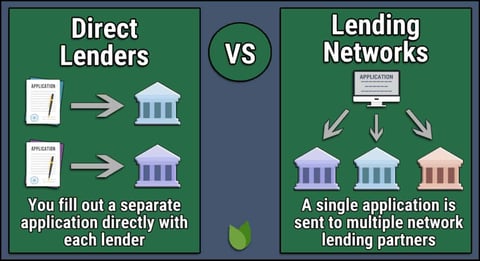

First things first: Fast Loan Advance isn’t a lender itself. Nope, it’s more like a matchmaker for folks who need cash fast. Think of it as the Tinder of loans—except instead of swiping for a date, you’re swiping (or rather, clicking) for a lender who’ll give you money. Based in California, this website links borrowers with a network of lenders offering personal loans, frequently customised to those with less-than-stellar credit. We’re talking APRs ranging from 5.99% to 35.99% and loan amounts up to $35,000. Pretty nice, right?

The main goal is quickness and simplicity. You fill out a fast online form—it takes about two minutes—and voila, you’re matched with lenders who might say yes. No tedious paperwork, no unpleasant bank trips. If you’ve got lousy credit or just need cash in a hurry, this sounds like a dream. But here’s the kicker: reviews are all over the place. Some people enjoy it, some… not so much. Let’s break it down.

Why People Turn to Fast Loan Advance

Let’s be real—nobody wakes up thinking, “Hmm, I’d love to borrow money today!” You’re presumably here because something urgent sprang up. Maybe your car broke down, or rent’s due and your pay cheque’s still a week away. Fast Loan Advance touts itself as the go-to for emergencies, and that’s why it’s developed a dedicated clientele.

One significant perk? Accessibility. Traditional banks may be picky—good credit, solid income, a million hoops to pass through. Fast Loan Advance, though? They’re all about inclusiveness. Subprime borrowers—aka individuals with terrible credit—get a shot here. Plus, the approval procedure is lightning-fast. Some individuals say they’ve obtained money in their bank account within 24 hours. That’s clutch when you’re in a jam!

Another reason it’s popular: transparency (well, somewhat). The website puts out loan examples so you can know what you’re getting into. No hazy promises—just figures like APRs and loan amounts upfront. But, as we’ll see in the reviews, not everyone’s experience meets the anticipation.

Digging Into Fast Loan Advance Reviews: The Good Stuff

Alright, let’s get to the interesting part—what are people saying? I’ve combed the web, from Trustpilot to obscure forums, and here’s the scoop on the great sentiments.

First off, speed is the MVP. Tonnes of borrowers marvel about how short the procedure is. One Trustpilot reviewer noted, “Fast Loan Advance made the entire financing procedure smooth and transparent. Their team worked effectively to ensure my application was finished in record time.” Another weighed up with, “I got my money the next day—lifesaver during an important situation!” If time’s ticking and you need cash ASAP, this tends to provide.

Customer service gets some love too. People love the personal touch—like lenders taking the time to understand their position. One user stated, “They supplied a solution that met my needs flawlessly. Excellent service!” That’s a significant thing when you’re anxious about money and just want someone to have your back.

Then there’s the range of alternatives. Since Fast Loan Advance links you with many lenders, you’re not locked with one offer. You may compare rates and terms, deciding what works best for you. Users call this “empowering” since it puts you in the driver’s seat. Oh, and no origination costs or prepayment penalties from some lenders? That’s a gain for keeping expenses down.

The Not-So-Great Side of Fast Loan Advance

Now, let’s flip the coin. Not every review is a five-star celebration. Some persons have gripes, and they’re worth hearing out before you rush in.

High interest rates are the biggie. Sure, APRs start at 5.99%, but they may escalate to 35.99%. Ouch! For someone with terrible credit, that’s not unusual—lenders take a risk, therefore they charge more—but it may still sting. One reviewer whined, “The fees were far more than I expected. Felt like I was burrowing myself deeper.” If you’re borrowing $5,000 at 35.99% over three years, you’re paying back a lot more than you borrowed. Do the math before you sign!

Hidden costs are another annoying issue. While Fast Loan Advance insists it’s honest, several consumers allege they got slammed with unexpected expenses after the fact. “No hidden fees? Yeah, right,” one individual complained online. The secret here is that Fast Loan Advance isn’t the lender—its partners are. So, the fine print depends on who you’re matched with. Read those phrases like your life relies on it!

Lastly, some persons feel inundated after applying. You give your info, and immediately your inbox and phone flood up with offers. “It’s like I opened Pandora’s box,” one user stated. If you’re fine with that, no biggie—but it’s a heads-up if you value privacy.

How Does Fast Loan Advance Stack Up Against Alternatives?

Okay, so Fast Loan Advance isn’t the only game in town. How does it compare to other quick-loan options? Let’s check out a few competitors.

LendingClub’s another marketplace, but it’s got a twist: peer-to-peer loans from individual investors, not just banks. Rates are comparable (6.34% to 35.89%); however, loan amounts top out at $40,000. Some believe LendingClub’s approval takes a touch longer, though—think a day or two vs. Fast Loan Advance’s next-day cash.

Then there’s Reprise. Smaller loans ($2,500 to $25,000), but they tout same-day approvals *and* financing. If speed’s your priority, Reprise could edge out Fast Loan Advance. Rates aren’t public, though, so you’d need to apply to see.

BadCredit.org also mentions networks like CashUSA and PersonalLoans.com. They’re in the same ballpark—quick cash, bad credit friendly—but user evaluations differ significantly. Fast Loan Advance looks to hold its own with a good 4-star Trustpilot rating (254 reviews and counting as of early 2025), which wins out over some shakier competitors.

Is Fast Loan Advance Legit?

Let’s tackle the million-dollar question: can you trust these guys? Short answer: sure, it’s genuine. Fast Loan Advance employs 256-bit SSL encryption to secure your data—fancy tech that keeps hackers away. They’re not a fraud coming up overnight; they’ve been around long enough to create a rep.

That said, “legit” doesn’t mean “perfect.” The platform’s only as good as the lenders it links you with. Some are awesome—low rates, flexible terms—others, not so much. Posts on X even claim it’s been “Voted Best Loan Finder” by Financial Services Review in February 2025. Cool, but take it with a grain of salt—hype doesn’t guarantee your experience.

My take? It’s a legitimate service, not a fly-by-night outfit. Just don’t blindly trust—vet your lender matches like a detective.

Who’s Fast Loan Advance Best For?

So, who’s the perfect consumer here? If you’ve got lousy credit and banks are giving you the cold shoulder, this might be your lifeline. It’s also useful if you’re in a rush—emergency costs don’t wait for payday. And if you prefer surfing around for loan offers without committing, the marketplace feel works.

On the flip side, if your credit’s decent or you can wait a few days, you could get better rates elsewhere. Same goes if you despise high interest—it’s a gamble with these subprime-focused services.

Tips for Using Fast Loan Advance Like a Pro

Thinking about giving it a shot at advance? Here’s how to make it work for you:

– **Compare Offers**: Don’t grab the first loan you’re matched with. Look at APRs, terms, and fees—the full enchilada.

– **Read the Fine Print**: Seriously, every word. Lenders sneak in fees or penalties that Fast Loan Advance might not disclose upfront.

– **Borrow Only What You Need**: That $35,000 cap is enticing, but don’t overdo it—high rates make extra income pricey.

– **Have a Payback Plan**: Know how you’ll repay before you borrow. A quick loan’s no good if it buries you in debt.

Real User Stories: What’s the Vibe?

Let’s build a picture with a handful of fictional (but perfectly feasible) user experiences based on Fast Loan Advance reviews.

Meet Sarah, a single mom whose fridge failed mid-month. She applied through Fast Loan Advance, obtained a $1,500 loan at 18% APR, and had cash in her account by morning. “It rescued me,” she’d remark. “Food kept cold, kids stayed happy.” She paid it off in six months—no regrets.

Then there’s Mike, a freelancer whose customer stiffed him. He borrowed $3,000 at 34% APR, assuming he’d clear it soon. Surprise costs crept up, and repayments wrecked his budget. “Wish I’d shopped around more,” he’d lament. Lesson learnt.

Two sides, one platform. Your tale relies on how you play it.

The SEO Angle: Why Fast Loan Advance Ranks High

Okay, nerd moment—why does Fast Loan Advance appear up when you search “quick loans”? They’re SEO experts. Keywords like “fast loan advance reviews,” “bad credit loans,” and “quick cash online” are strewn around their site organically. They’ve got a clean, crawlable layout—Google loves that. Plus, they’re pouring out material (like lending recommendations) that keeps them relevant.

Reviews help too. User conversation on Trustpilot, X, and blogs indicates to search engines that people care. That 4-star rating? Gold for trustworthiness. Competitors could outrank them on backlinks, but Fast Loan Advance nails on-page SEO and user engagement.

What’s the Word on the Street in 2025?

According to Fast Loan Advance reviews, as of February 25, 2025, Fast Loan Advance is holding well. Economic vibes are shaky—rising expenses, restricted budgets—so quick-loan demand’s up. Reviews mirror that: more persons applauding the quickness, but also more griping about rates as borrowing grows pricier. X postings hint at fresh buzz, like the “Best Loan Finder” mention. They’re adjusting, but the underlying pros and downsides haven’t budged.

Should You Try Fast Loan Advance?

Alright, let’s land this plane. Fast Loan Advance reviews isn’t a magic wand, but it’s a good tool if you’re in a problem. The good? Lightning-fast approvals, bad-credit-friendly, and a menu of lender possibilities. The not-so-good? High rates, possible surcharges, and a deluge of follow-up solicitations. It’s authentic, it’s fast, but it’s not cheap.

My advice? If you’re desperate for cash and can handle the repayment, go for it—just be wise about it. Compare, read, plan. If you’ve got time or better credit, browse around first. Either way, you’ve got the entire scoop now. What’s your next move? Drop a comment if you’ve used it—I’d love to hear your thoughts!