OVERVIEW

If you are reading this, chances are you came across the word “DSCR loan requirements” and wondered, “What’s that all about?” Perhaps you are a company owner trying to fund a new project or a real estate investor staring at a great property. You are at the correct spot either way.

Short for Debt Service Coverage Ratio loans, DSCR loans are a major issue in the lending scene, particularly for those who deviate from the standard definition of conventional bank financing. By the time you finish reading, you will know precisely:

- what a DSCR loan is,

- why it matters, and

- what hoops you will have to go through to grab one.

What is a DSCR loan?

A DSCR loan is a sort of financing where the lender cares more about the revenue your property or business generates than your personal credit score or tax filings. The Debt Service Coverage Ratio (DSCR) is a fancy little statistic that tells lenders whether your property’s income can cover the loan obligations. Think of it as a safety net—if the ratio’s good, they’re more willing to fork up the cash.

Typically, these loans are a go-to for real estate investors buying rental homes, commercial structures, or even multifamily apartments. Why? Because they’re adaptable. Traditional banks would interrogate you over every cent in your personal bank account, but DSCR lenders? They’re laser-focused on whether the property can pay for itself. It’s a game-changer whether you’re self-employed, have a lousy credit history, or just don’t want to sift through years of tax documents.

But here’s where it gets interesting: to qualify, you’ve had to fulfil certain precise DSCR loan requirements.

Understanding the DSCR Ratio

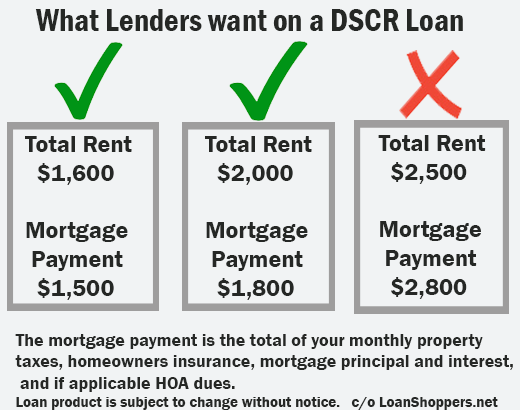

This is the core of the loan, and it’s not as difficult as it seems. The formula’s simple: DSCR = Net Operating Income (NOI) ÷ Total Debt Service. In human terms? It’s your property’s income (after costs) divided by the loan payment. Lenders normally prefer this figure to be at least 1.0, implying your income meets or exceeds the debt. But here’s the catch—most like a cushion, like 1.25 or greater. Why the buffer? Because life occurs.

Tenants move out, repairs pop up, or rents decrease. A higher DSCR (say, 1.25) suggests there’s wiggle room to service the debt even if things turn difficult. For example, if your rental property takes in $5,000 a month after costs and your loan payment is $4,000, your DSCR is 1.25. Boom—you’re in the sweet area for most lenders. Now, don’t panic if arithmetic isn’t your thing. Lenders determine this for you depending on the property’s financials. Your job? Make sure the property’s a cash cow—or at least close to it. That’s the first important requirement: a good DSCR ratio. But it’s hardly the only one.

DSCR loan requirements: Property Type Matters

Not every hut or skyscraper qualifies for a DSCR loan. Lenders have preferences, and they’re extremely particular about what they’ll fund. Residential rentals? Single-family houses, duplexes, or tiny apartment complexes. Commercial properties? Absolutely—warehouses, office spaces, or retail strips are fair game. But that fixer-upper you want to flip in six months? Nope. DSCR loans are meant for income-producing homes, not fast flips or vacant lots. The condition matters too.

If the home is falling apart—think leaking roofs or shattered plumbing—lenders could hesitate. They want something reliable that’s already generating income or can start immediately. A gleaming new apartment complex? Perfect. A deteriorating warehouse with no tenants? Not so much. Some lenders could still bite if you’ve got a strong strategy to lease it up fast, but you’ll need to show it. Oh, and location is huge. A rental in a bustling metropolis with great demand outperforms a ghost town property any day. Lenders peep at market trends, vacancy rates, and rental prospects. So, when you’re eyeing that DSCR loan, find a home that’s got income written all over it.

DSCR loan requirements: Income Documentation

Here’s where things get juicy—proving the property’s income. Unlike standard loans that concentrate on your income, DSCR loans zero in on the property’s cash flow. But you can’t just say, “Trust me, it’s a goldmine.” Lenders require proof, and they’re not bashful about asking for it. For an existing property, it includes lease papers, rent rolls, and bank statements reflecting those delicious deposits. If it’s a business property, they could seek profit-and-loss figures or tenant contracts. New property with no history? Tricky, but not impossible.

Some lenders accept predicted income based on market rents—just supply credible proof, such appraisals or comparable properties nearby. This part is essential since it flows right into the DSCR ratio we spoke about. Skimp on documentation, and you’re doomed. Overstate the income, and they’ll smell it out. Be honest, be thorough, and you’ll fly through this process.

Credit Score

DSCR loans don’t ignore your credit score; they just don’t worship it. Traditional loans would demand a dazzling 700+, but DSCR lenders are chill—sometimes as low as 620 or even 600 gets you in the door. Why? Because the property’s revenue is the true MVP here. That so, a decent score still helps. It might snag you better interest rates or cheaper down payments. If your credit’s a dumpster fire (say, below 600), certain lenders could say no—or charge you an arm and a leg in fees. So, while it’s not the headliner, don’t sleep on your credit. Give it a quick check before applying, and maybe pay off that old credit card debt to appear a bit sharper.

Down Payment: Cash Up Front

Speaking of cash, let’s talk down payments. DSCR loans aren’t handouts—you’ll need skin in the game. Most lenders ask for 20% to 30% of the property’s worth upfront. So, a $500,000 building? That’s $100,000 to $150,000 out of your pocket. Ouch, right? But that’s typical for investment homes, and it shows you’re serious. Here’s a plus, though: some lenders allow you utilise the property’s equity (if you already own it) or even cash reserves to offset this. Others could flex a touch if your DSCR ratio’s sky-high—like 1.5 or more. Still, don’t anticipate a zero-down bargain. That’s unicorn territory for DSCR loans.

Reserves: Your Rainy-Day Fund

Ever heard the saying “hope for the best, plan for the worst”? That’s the attitude with reserves. Many DSCR lenders want you to have a hoard of cash—typically 6 to 12 months’ worth of loan payments—sitting neatly in an account. Why? To cover the mortgage if tenants flake or repairs exhaust your pocketbook. For a $4,000 monthly payment, that’s $24,000 to $48,000 in reserves. It’s a heavy ask, but it’s not always set in stone. Strong credit, a fantastic DSCR ratio, or a rock-solid property may drop it down to 3 or 6 months. Either way, it’s about showing you won’t default at the first sight of crisis.

Experience: Newbies Welcome (Sort Of)

Good news if you’re new to the real estate game—DSCR loans don’t usually necessitate an extensive resume. Some lenders appeal to first-timers, especially if the property’s a slam dunk. But here’s the other side: seasoned investors frequently get better terms—lower rates, less scrutiny—because they’ve got a track record. If you’re green, don’t stress it. Focus on a property with solid stats and maybe link up with a pro (like a property manager) to bolster your case. Lenders just want to ensure you won’t collapse and burn.

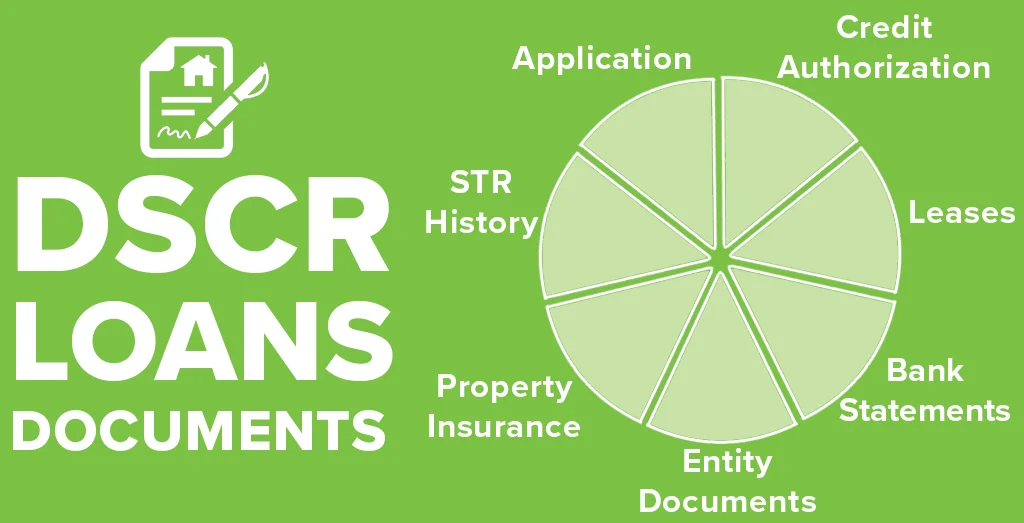

DSCR Loan Application Process: What to Expect

So, you’ve got the land, the cash, and the guts—now what? Applying for a DSCR loan is relatively basic. You’ll provide the property’s financials (leases, income documentation), your credit info, and some personal facts. Lenders could ask for an evaluation to establish the property’s worth and revenue prospects. Then, they crunch the statistics. Approval might take a few weeks, shorter if you’re organized. Rates? They’re frequently costlier than regular mortgages—think 5% to 8%—because these loans are riskier for lenders. Terms vary too, from 5 to 30 years, generally with set or customisable choices. Shop around—every lender’s got their own taste.

Why Bother With a DSCR Loan Requirements?

At this point, you might question, “Why not just hit up a bank?” Fair question. DSCR loans shine for those who don’t fit the bank’s box—self-employed hustlers, investors with several homes, or anybody evading tax-return pain. Plus, they’re speedy. Traditional loans might drag on for months; DSCR agreements routinely conclude in weeks. The trade-off? Higher rates and tougher property regulations. But if you’ve got a cash-flowing treasure, it’s worth it. You’re betting on the property, not your own finances—and that’s a strong move.

Calculating the DSCR.

The debt-service coverage ratio formula takes into account both net operating income and total debt servicing for a company. Net operating income is a company’s revenue less specific operating expenditures (COE), excluding taxes and interest payments. It is frequently regarded as equivalent to earnings before interest and taxes (EBIT).

DSCR = Net Operating Income. Total Debt Service: Net Operating Income = Revenue – COECOE = Certain Operating Expenses. Total Debt Service = Current debt commitments. DSCR = Total Debt Service. Net operating income is calculated as revenue less certain operational expenditures (COECOE). Total Debt Service = Current debt commitments.

- Total debt service refers to all existing debt obligations, including interest, principal, sinking fund, and lease payments due in the following year. This will include both short-term debt and the present component of long-term debt on a balance sheet. 1

Income taxes complicate DSCR calculations since interest payments are tax-deductible while principal repayments are not. A more accurate technique to calculate total debt service is as follows:

TDS = (Interest × (1-Tax Rate) + Principal) where TDS = Total Debt Service TDS = (Interest × (1-Tax Rate) + Principal) where TDS = Total Debt Service

DSCR loan requirements: Lender Considerations:

The debt-service coverage ratio measures a company’s capacity to service debt given its income level. The DSCR measures a company’s cash flow and can predict how likely it is to qualify for a loan. Lenders routinely review a borrower’s DSCR.

A DSCR of 1.00 shows that a corporation generates precisely enough operational revenue to cover its debt-servicing obligations. A DSCR of less than 1.00 indicates negative cash flow. The borrower may be unable to meet current debt obligations without relying on outside sources or borrowing more.

A DSCR of 0.95 indicates that there is only enough net operating income to cover 95% of annual debt payments.

If the debt-service coverage ratio is too close to 1.00, the entity may appear vulnerable, and even a minor decrease in cash flow may render it unable to service its debt. Lenders may compel the borrower to maintain a minimum DSCR while the loan is outstanding.

DSCR loan requirements: Interest Coverage Ratio vs DSCR

The interest coverage ratio represents the number of times that a company’s operational earnings will cover the interest it must pay on all loans for a particular period. This is expressed as a ratio and is typically computed annually.

Divide the EBIT for the specified period by the total interest payments due for the same period.

The EBIT is commonly referred to as net operating income or operating profit. It is estimated by deducting overhead and operational expenditures, including rent, cost of products, freight, labour, and utilities from revenue.

The greater the ratio of EBIT to interest payments, the more financially secure the company. This measure only examines interest payments and not payments made on principle loan sums that may be demanded by lenders.

The debt-service coverage ratio measures a company’s capacity to make minimum principal and interest payments, including sinking fund payments. The DSCR is calculated by dividing EBIT by the entire amount of principal and interest payments necessary for a particular period in order to produce net operating income. It takes principal payments into account in addition to interest hence the DSCR is a more solid indication of a company’s financial wellness.

Advantages and disadvantages of DSCR.

The DSCR is a frequent statistic used in loan negotiations, although it has certain advantages and disadvantages.

Advantages

The DSCR has value when measured consistently over time, much like other ratios. A company can calculate monthly DSCR to analyse its average trend and project future ratios. A falling DSCR may be an early warning indication of a company’s financial downfall, or it can be utilized extensively in budgeting and strategic planning.

The DSCR might also have comparability across various firms. Management could utilise DSCR estimations from its rivals to examine how it’s performing relative to others. This might entail examining how well other firms use loans to achieve business growth.

The DSCR is a more complete analytical approach for measuring a company’s long-term financial health. The DSCR is a more cautious, comprehensive estimate than the interest coverage ratio.

The DSCR is also an annually ratio that frequently refers to a moving 12-month period. Other financial ratios are often a single picture of a company’s health. The DSCR may be a more accurate depiction of a company’s activities.

Disadvantages

The DSCR computation can be changed to reflect net operating income, EBIT, or profits before interest, taxes, depreciation, and amortisation (EBITDA). It depends on the lender’s criteria. The company’s income may be overestimated because operating income, EBIT, and EBITDA do not account for all costs. In none of the three scenarios, income includes taxes.

Another shortcoming of the DSCR is its reliance on accounting guidelines. Debt and loans are based on required cash payments, while the DSCR is largely determined using accrual-based accounting guidelines. There is some contradiction when comparing a set of financial statements based on generally accepted accounting standards (GAAP) to a loan arrangement that requires fixed cash payments.

Conclusion: Your Path to DSCR Success

And there you have it—your crash course on DSCR loan requirements! From nailing that 1.25 ratio to finding the perfect home, it’s all about proving lenders the money’s there. Sure, you’ll need a substantial down payment, some reserves, and a dash of creditworthiness, but the payoff? Financing that increases your enterprise without going through traditional hoops. Whether you’re a rookie or a pro, these loans may unlock doors—if you play your cards well. So, what’s your next step? Find that perfect property, analyse the figures, and go for it.