Hey there! Ever heard someone toss around the term “10-year Treasury yield” and wondered what the heck they’re talking about? Maybe you’ve seen it pop up on the news or overheard it at a coffee shop. It sounds like some Wall Street jargon, but trust me—it’s not as complicated as it seems, and it’s actually pretty relevant to your life. In this deep dive, we’re unpacking everything about the 10-year Treasury yield: what it is, how it works, why it matters, and how it shakes up the economy. Let’s jump in and figure this out together—it’s going to be a wild, info-packed ride!

So, What’s the 10-Year Treasury Yield Anyway?

Alright, let’s break it down. The 10-year Treasury yield is basically the interest rate the U.S. government pays on its 10-year Treasury note. Think of it like this: when the government needs cash, it borrows money by selling these notes to investors. In return, those investors get paid interest over 10 years. The yield is the interest rate, expressed as a percentage. Simple, right?

Here’s the kicker—it’s not set in stone. The yield changes daily based on what investors are willing to pay for those notes. If they’re snapping them up, the yield drops. If they’re dumping them, it climbs. It’s like a financial tug-of-war, and the result ripples through everything from your mortgage to the stock market. Cool, huh?

Why 10 Years? Why Not 5 or 20?

Good question! The 10-year note is the Goldilocks of Treasuries—not too short, not too long, just right. Short-term stuff like the 2-year note moves fast and reflects quick shifts in policy, while the 30-year note is more about long-haul bets. The 10-year sits in the sweet spot, giving a solid read on where the economy’s headed over a decent stretch. That’s why it’s the go-to benchmark for banks, investors, and even regular folks like us trying to make sense of things.

How It’s Set: The Auction Action

So, how does this yield get decided? Picture an auction. The U.S. Treasury holds these big sales where investors—think banks, hedge funds, and even foreign governments—bid on the notes. The price they pay depends on demand. High demand means they’ll pay more, which lowers the yield (it’s an inverse thing—more on that later). Low demand? They pay less, and the yield shoots up.

After the auction, the notes trade in the secondary market, where prices bounce around based on news, vibes, and economic data. That’s where the yield we hear about comes from—it’s the real-time pulse of what’s happening out there.

The Inverse Magic: Price vs. Yield

Here’s where it gets trippy. The price of the note and its yield move in opposite directions. If investors are jazzed about safety (say, during a crisis), they pile into Treasuries, driving prices up and yields down. If they’re feeling risky and chasing stocks instead, Treasury prices drop, and yields spike. It’s like a seesaw—when one side’s up, the other’s down. Wrap your head around that, and you’re halfway to understanding this beast!

Why It’s a Big Deal for the Economy

Okay, so why should you care? The 10-year treasury yield is like the economy’s heartbeat. It influences everything. Banks use it to set mortgage rates—if the yield jumps, your dream home’s loan gets pricier. It affects car loans, credit cards, and even savings accounts. When it’s low, borrowing’s cheap, and people spend more. When it’s high, wallets snap shut, and growth slows.

It’s also a crystal ball for investors. A rising yield might signal confidence in the economy—or worries about inflation. A falling yield? Could mean a recession’s looming. Back in 2019, the yield curve (comparing short- and long-term rates) inverted, and folks freaked out, predicting a downturn. Spoiler: They weren’t wrong!

The Fed Factor

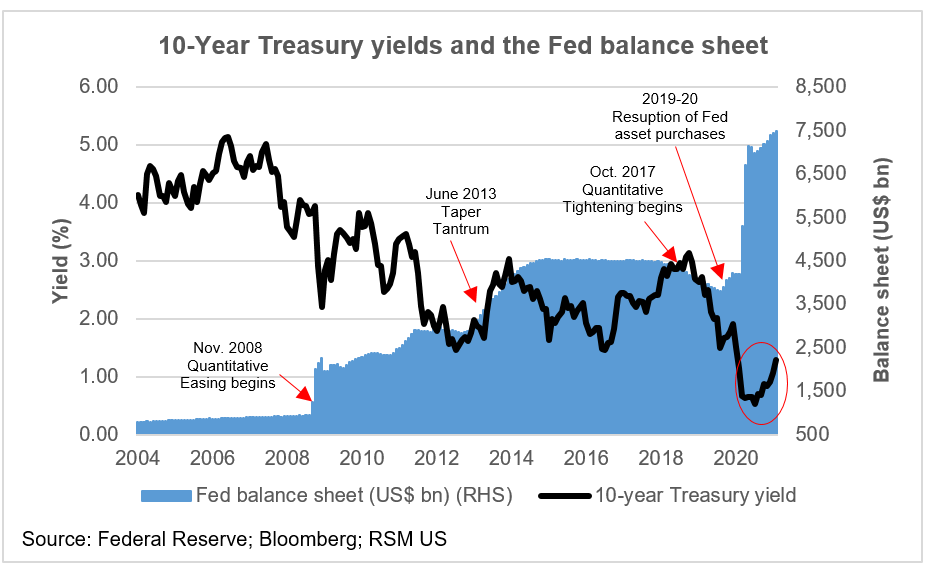

Let’s talk about the Federal Reserve—they’re the puppet masters here. The Fed doesn’t directly control the 10-year treasury yield (that’s market-driven), but it sets the tone with short-term rates. When they hike rates to cool inflation, the 10-year often follows suit as investors expect tighter money. When they slash rates, like during COVID, yields can tank as everyone scrambles for safe bets. It’s a dance between policy and market mood.

Inflation: The Yield’s Frenemy

Inflation and the 10-year treasury yield are tight-knit. If prices are rising fast, investors demand higher yields to offset the cash’s shrinking value. Think of it like this: if a burger costs $5 today but $6 next year, a 2% yield won’t cut it—you’re losing buying power. So, yields climb. But if inflation’s tame, like it was in the early 2010s, yields chill out. Right now, in April 2025, inflation’s been a rollercoaster—keep an eye on it!

What’s Happening in 2025?

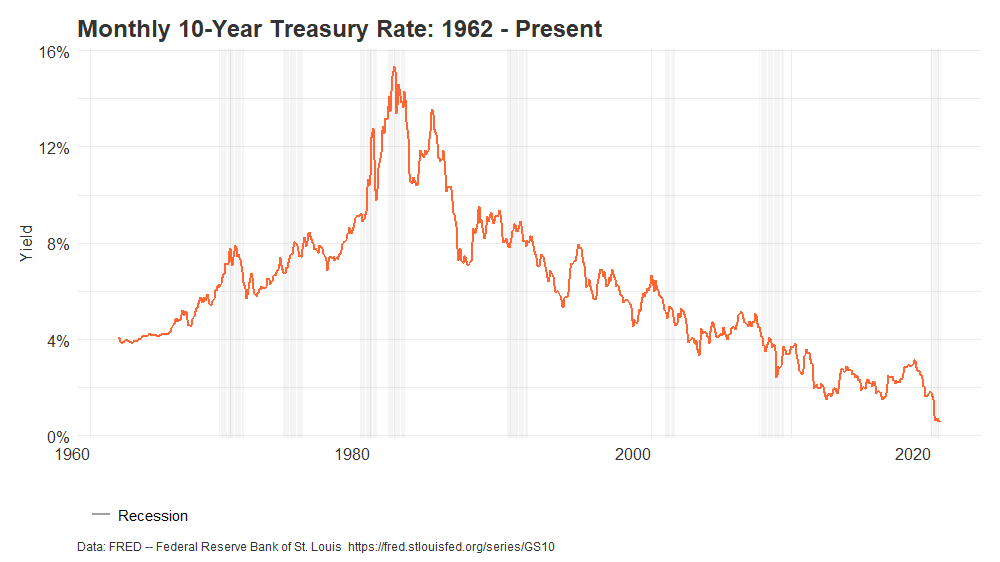

Speaking of now, let’s zoom in. As of April 2025, the 10-year treasury yield has been bouncing around—last I checked, it was hovering near 4%, but don’t quote me; it shifts fast! Post-COVID recovery, rate hikes, and global uncertainty have kept it jumpy. Remember 2023? Yields hit 5% as the Fed battled inflation, spooking markets. Today, it’s a mixed bag—some say it’ll climb if growth picks up; others bet on a dip if things stall. What’s your guess?

How It Hits Your Wallet

Let’s make it personal. If you’re eyeing a mortgage, a 1% yield jump could tack hundreds onto your monthly payment. Saving up? High yields might boost bond returns, but low ones leave your cash stagnant. And if you’re in stocks, watch out—rising yields can tank share prices as investors ditch risk for safety. It’s a domino effect, and you’re in the game whether you like it or not.

Historical Highs and Lows

Want some context? The 10-year treasury yield had wild swings. Back in the ‘80s, it hit 15%—imagine that on a mortgage! By 2012, it sank below 2% as the Fed pumped money post-crisis. During COVID, it flirted with 0.5%, freaking everyone out. These ups and downs tell a story of wars, booms, busts, and recoveries. Where we’re at now is just another chapter.

Yield Curve Drama

Ever heard of the yield curve? It’s when you plot yields across maturities—2-year, 10-year, and 30-year. Normally, it slopes up; longer terms mean higher yields. But when short-term yields top the 10-year, like in 2019, it inverts, and that’s a recession red flag. Investors watch this like hawks. Right now, it’s worth a peek—any weird kinks could hint at what’s next.

Global Vibes and the Yield

The 10-year treasury yield isn’t just a U.S. thing—it’s global. Foreign investors love Treasuries for their safety, especially when Europe or Asia gets shaky. If Japan’s rates are negative or Germany’s Bunds tank, more cash flows here, pushing yields down. In 2025, with China’s economy wobbling and EU tensions, that’s a big factor. It’s like the world’s playing hot potato with money!

Predictions: Crystal Ball Time

So, where’s this headed? Analysts are all over the map. Some say yields could hit 5% if inflation roars back or the Fed keeps tightening. Others see a drop to 3% if growth falters or a crisis hits. Me? I’d say watch jobs data and Fed speeches—those are the tea leaves. What do you think—up, down, or sideways?

How to Play It Smart

You don’t need a finance degree to ride this wave. If yields rise, lock in a mortgage fast or shift investments to bonds. If they fall, refinance debt or scoop up stocks on the dip. Stay curious—check sites like Treasury.gov or Bloomberg for updates. Knowledge is power, and you’ve got the tools now!

Myths to Bust

Let’s clear the air. “The yield only matters to rich investors”—nah, it hits us all. “It’s all the Fed’s fault”—not quite, markets call shots too. “Low yields are always bad”—tell that to borrowers loving cheap loans! Don’t fall for the hype; dig into the facts.

Real-Life Impact Stories

Picture this: Jane, a 30-something teacher, snagged a 3% mortgage in 2021 when yields were low—and saved her thousands. Then there’s Tom, an investor who got burned in 2023 when yields spiked and stocks crashed. These aren’t just numbers; they’re lives. How’s it hitting you?

U.S. Treasury yields were falling early Monday as safe-haven demand surged and concerns about recession grew

Treasury yields are the interest rates that the U.S. government pays to borrow money for varying periods of time. Treasury yields are inversely related to Treasury prices, and yields are often used to price and trade fixed-income securities, including Treasuries.

Unfortunately, the 10-year Treasury bond yield is up.” “Why is this happening? Fixed-income investors may be starting to worry that the Chinese and other foreigners might start selling their US Treasuries,” added Yardeni. Meanwhile, the Fed may be hesitant to cut rates with tariffs around the world raising inflation.

Conclusion: Your Yield Playbook

The 10-year Treasury yield isn’t some dusty stat—it’s a living, breathing force shaping your money and the world. From mortgages to markets, it’s the thread tying it all together. Now you know the what, why, and how—so what’s your move? Keep an eye on it, tweak your plans, and chat about it with me below. Let’s ride this economic wave together!